Like the larger beverage market, the wine industry was impacted this year – both positively and negatively – by consumers trending toward occasion-based drinking. This year’s Growth Brand winners include stalwart brands able to keep up with shifting wine preferences, as well as newcomers that are expanding the traditional definition of wine.

“The wine industry is facing its most competitive market in history, causing many quality brands to post flat or slightly declined sales,” says Adam Rogers, Manager of Information Services for The Beverage Information & Insights Group. “This year’s growth has come primarily from newer products in certain segments, such as red blends, Prosecco and Cava. These new wines are attracting a lot of attention, especially with Millennial consumers, and creating a niche for themselves within the industry.”

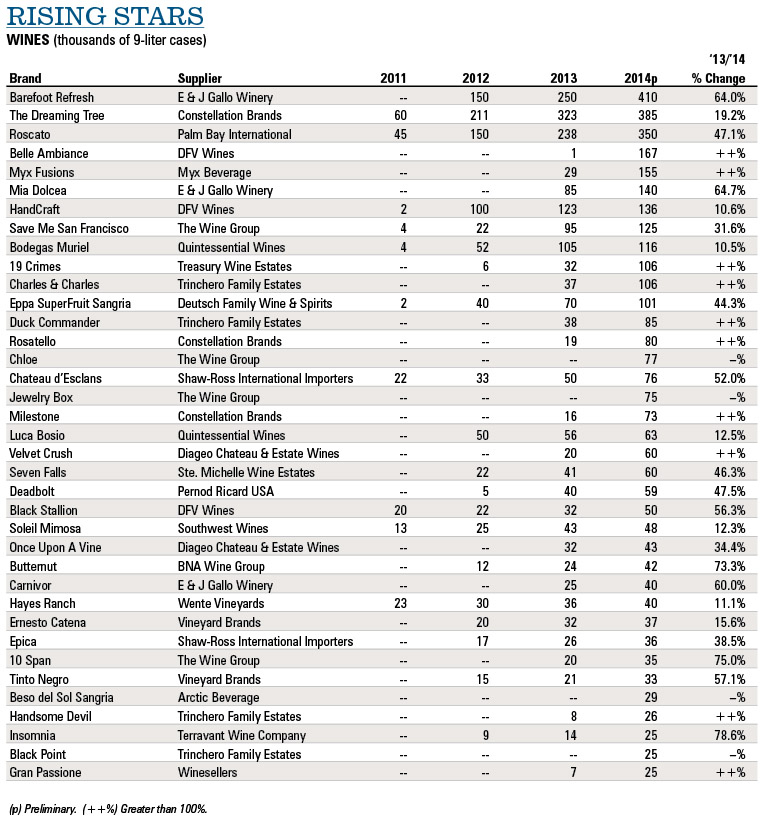

Rogers points out that quality table wine brands, like Leese-Fitch, were noticeably absent from this year’s list. In many cases, previous Fast Track winners didn’t grow the necessary 10% in 2014 to remain in that category, and also haven’t reached 400,000 nine-liter cases to qualify as an Established Growth brand. But the winners do include first timers that capitalized on industry trends.

“Myx Fusion’s first-year case sales were very impressive, which translates back to creating a niche through spokeswoman Nicki Minaj,” Rogers says.

Spanning the Portfolio

A number of wines, both mature brands and newcomers, from the Delicato Family Vineyards family earned Growth Brand Awards this year. Despite falling under a single supplier, Belle Ambiance, Gnarly Head and Hand Craft each represent a different target consumer and a different stage of the brand growth cycle.

“The 2014 launch of Belle Ambiance was the largest in Delicato Family Vineyards history,” says Brand Manager Charene Beltramo. “The brand was embraced early by distributors and retailers. For 2015, our promotions include a significant focus on wedding season, which presents opportunities with all channels at different times of the year.”

HandCraft launched three years ago. The brand’s proprietor, third-generation vintner Cheryl Indelicato, is an active supporter of breast cancer awareness and has contributed more than $220,000 toward finding a cure.

“Cheryl’s exposure in market as an active participant at the street level has resonated with consumers and been a major factor in the continued growth of the brand,” Beltramo says. “HandCraft will be involving consumers in multiple interactive campaigns tied to breast cancer awareness in 2015.”

In addition to community outreach through its involvement with the Lynne Sage Foundation, which sees specific consumer opt-in activations at retail, the brand is also launching a Pinot Grigio and Malbec to the portfolio this year.

As a more mature brand in the DFV portfolio at 10 years old, Gnarly Head has built brand awareness out-of-store through social media and digital campaigns, as well as working with retailers to create impactful POS.

“Innovation has also been a key cornerstone for our brand,” says Brand Director Nick Banuelos. “The launch of Authentic Black, a limited release red blend in the fall, sold out in less than 30 days and provided incremental volume for the brand.”

In the coming year, Gnarly Head will utilize mobile-influenced, in-store sales driving platforms, a category the brand believes will grow tremendously in the next few years as mobile applications allow rich communication with consumers and drive traffic into retail locations.

Getting into Consumers’ Hands

Soleil Mimosa’s key to success is very simple. “We believe that our most effective marketing and promotion programs have been to get our wine into consumers’ hands,” says Sandra Pacheco, National Sales Director for Southwest Wines. “We’ve done that by working with our retail and on-premise partners to conduct demonstrations and tastings, where consumers are able to taste the quality of our product for themselves.”

Ron Barcelo has seen similar success with its tasting program. “Barcelo was promoted through tastings in both the on- and off-premise in key markets,” says VP and Sr. Brand Manager at Shaw-Ross International Importers, Nick James. “We believe the quality of the product speaks for itself once consumers experience it.”

The New Wine on the Block and the Comeback Wine

Winesellers brand Gran Passione earned a Rising Star award for the first time this year, thanks largely to a Wines of Italy national promotion with Whole Foods Market in 2014. It was selected as one of eight wines featured in the program and represented red wines from Northern Italy.

“The program was a huge success,” says VP of National Accounts Jordan Sager. “We devoted a fair share of resources to build a strong marketing and sales campaign to lift the profile of the entire Gran Passion range in both on- and off-premise.”

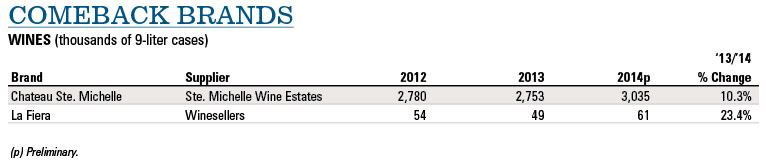

The company’s other Growth Brand winner, La Fiera, is one of two Comeback Brands on this year’s list. Since its launch in 2010 the brand had experienced consistent sales growth, until supply issues in 2013 led to stagnant sales. The value-driven Italian brand added a Sicilian Moscato and Bianco & Rosso blend in 2014, leading to increased sales and the Comeback Brand recognition.

“The brand is on track and moving in the right direction,” Sager says. “We intend to maintain our competitive pricing structure to appeal to retail consumers and attract new by-the-glass restaurant business in 2015 to maintain the momentum.”

We also initiated the tagline, “Here’s to Your Next Adventure,” which we promoted through Facebook, encouraging consumers to share their everyday adventures via comments and images.

Woodbridge by Robert Mondavi, Constellation Brands, Established Growth, 2014 Cases: 9.15m (+2.0%)

Woodbridge engaged with consumers in a number of unique ways during 2014, including the “Moments Worth Sharing” campaign during the summer and holiday seasons, a partnership with No Kid Hungry and working with HGTV star Sabrina Soto to host a Dream Thanksgiving contest.

“2014 was a banner year for Woodbridge by Robert Mondavi,” says Jon Guggino, Vice President of Marketing for Robert Mondavi and Premium Wines at Constellation Brands. “Building upon last year’s success, we’re entering 2015 with plans that will resonate with consumers.”

Upcoming campaigns include a “Summer Block Party” that will play out through digital, in-store promotions and media activations, as well as supporting local food banks during the holidays through the brand’s “Holiday Traditions” platform.

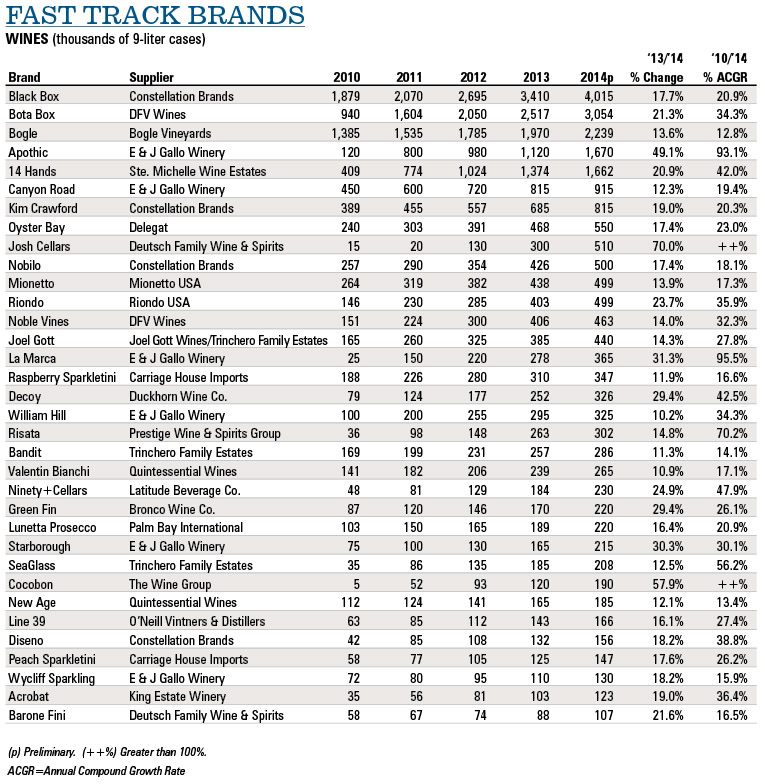

Bota Box, DFV Wines, Fast Track, 2014 Cases: 3.05m (+21.3%)

Q&A with Mark Koppen, Brand Director for Bota Box.

SW: What promotions in 2014 contributed most to sales growth for Bota Box?

MK: As the original eco-friendly box wine, we’re a proud partner of the Arbor Day Foundation and 2014 was the sixth consecutive year that Bota Box teamed up with them to support reforestation. More than 50,000 trees were planted as a result in the past year.

We also initiated the tagline, “Here’s to Your Next Adventure,” which we promoted through Facebook, encouraging consumers to share their everyday adventures via comments and images.

SW: What industry trends are most contributing to the success of Bota Box right now?

MK: Modern day wine consumers want a more approachable, everyday drinking with that offers a softer, smoother and more fruit-forward profile. Bota wines fill that niche. The core wine consumer population also wants an accessible wine that pairs with a wide variety of foods at the dinner table.

SW: What are you planning for 2015 that will maintain Bota Box’s growth trajectory?

MK: This year our Pinot Noir and Sauvignon Blanc are hitting broad distribution, joining the 1.5L Bota Brick, which launched within the last few months. We’ve also retained a new integrated public relations agency to expand our “Here’s to Your Next Adventure” campaign in content-driving mediums, both online and offline.

Kendall-Jackson, Jackson Family Wines, Established Growth, 2014 Cases: 3.24m (+1.3%)

“We continue to invest in the Kendall-Jackson brand across multiple disciplines, including brand marketing, trade marketing, digital and social,” says Corinne Nosal, Sr. Communications Manager at Jackson Family Wines.

In 2014, the company launched two new line extensions for Kendall-Jackson Avant, in addition to targeted event and multicultural campaigns aimed at attracting a younger consumer to the brand. In 2015, Jackson Family Wines plans to build on the success of those campaigns, investing in the brand to build relevance with its younger audience.

“We’ll still remain an attractive, quality offering for our current consumers who are Kendall-Jackson loyalists and have been for many years,” Nosal says. “And we’ll continue to focus on producing high-quality wines from the best regions in coastal California.”

Mionetto, Mionetto USA, Fast Track, 2014 Cases: 0.50m (+13.9%)

“We think 2015 will be an interesting and positive year, when we will continue to develop and support our brand across the sales channels with more consumer programs and additional focus in the currently underdeveloped trade channel, which has great growth potential,” says Enore Ceola, Managing Director at Mionetto USA.

The brand recently implemented a chain program in certain regions where it has a strong base with independent accounts, which has led to significant growth and development in those markets.

Riondo, Riondo USA, Fast Track, 2014 Cases: 0.50m (+23.7%)

Riondo is continuing its focus on-premise to effectively compete with the arrival of large brands in the Prosecco category that aren’t from Italy. “We are looking to make real Prosecco, not commercial-grade, low-end sparkling wines,” says John Blesse, Vice president of Riondo USA. “The sparkling consumer is extremely brand loyal and we look forward to securing our long-term consumer base via quality and price.”

During 2014, the company benefited from its long-term commitment to key retail accounts and on-premise accounts like Blu and Spago 187. “The on-premise focus has led to our greatest growth amongst our Proseccos,” Blesse adds.

Epica, Shaw-Ross International Importers, Rising Star, 2014 Cases: .04m (+38.5%)

In late 2013, Epica underwent a packaging redesign to strengthen the brand’s visibility at point of purchase, which updated both the bottle and the case graphics. “The new packaging is imaginative and strong, with graphics that lend themselves to display,” says Nick James, VP and Sr. Brand Manager at Shaw-Ross International Importers.

The brand has also strengthened its consumer offers with year-round activities. “From the use of Go Pro Cameras, which are very much in line with our consumer profile, to a contest inviting them to become ‘The Face’ of Epica in 2016, we believe our consumers will enjoy these new campaigns,” he adds. “All of our programs are communicated on the bottle, as well as on Facebook and other social media.”

Epica will also continue to invest heavily in tastings, which James says has been a key to the brand’s success.

Decoy, Duckhorn Wine Company, Fast Track, 2014 Cases: 0.33m (+29.4%)

“We invest the majority of our resources into areas that further enhance wine quality – most notably, things like estate vineyards and the thousands of French oak barrels in our cooperage program,” says Carol Reber, SVP Chief Marketing and Business Development Officer at Duckhorn Wine Company. “That’s resulted in great word of mouth and the recognition of our 35-plus years of exceptional winemaking across all of our wineries and appellations.”

Duckhorn recently acquired a 90-acre vineyard in Russian River Valley, which is planted to Pinot Noir and Chardonnay and will contribute fruit to future Decoy vintages. The company strives for 20% estate vineyard contribution for all Decoy wines, which is achievable with the acquisition.

“We’ll also continue to engage luxury wine consumers through social media to ensure that the brand is where digitally-minded consumers and trade are talking about fine wine,” Reber adds.