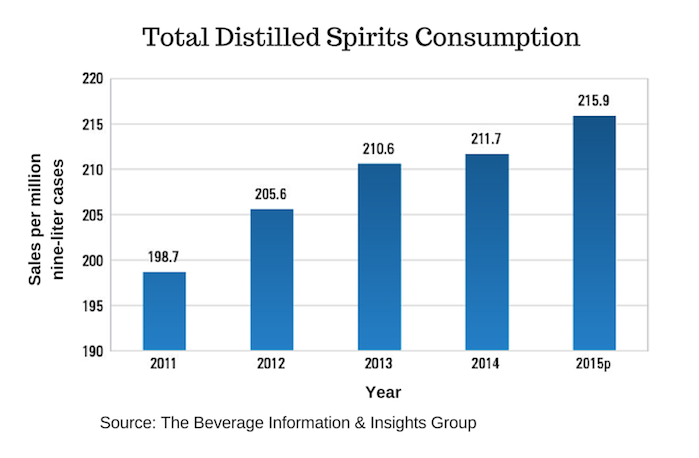

Alcohol sales are largely trending in the right direction.

For instance, distilled spirits posted another year of steady volume growth in 2015, according to the Beverage Information & Insights Group, the research unit of StateWays’ parent company. The just-published 2016 Handbook Advance reports that total distilled spirits consumption reached a projected 215.9 million nine-liter cases last year, up from 211.7 nine-liter cases the year prior. (This is pictured in the chart above.)

Marybeth Came, Beverage Information Group’s director of client services, recently presented a preview on spirits, wine and beer consumption trends at the Women’s Beverage Alcohol Symposium in Newton, MA. Here’s a summary of the highlights:

1. Pockets of growth in distilled spirits consumption included brandy and Cognac (up 5.6% over 2014), tequila (up 4.4%) and all things whiskey.

2. Brown spirits, particularly straights (which reached 19.7 million nine-liter cases in 2015), continue to captivate consumers’ interest as they are perceived as heritage-filled and authentic, traits that play directly into the purchasing prerequisites of today’s customers.

3. Modest growth continues in the vodka category (up 1.1% from 2014), but deceleration can be associated with flavor fatigue, especially among imported offerings.

4. Volume growth in the beer category was flat year over year, as today’s consumers continue to move away from mainstream and flagship brands toward imports, higher-end craft and super-premium offerings.

5. The total wine segment increased 2.0% in 2015, led by significant gains in the sparkling category.

6. Millennial consumers are drinking more distilled spirits, particularly vodka, tequila and rum.

7. Older Millennials (age 25 to 34) are drinking more wine with a preference for table and sparkling wines; they’re also driving beer consumption, favoring imports, light beers and craft offerings.

For more information about the Handbook Advance and other beverage alcohol industry data from BIIG, visit www.albevresearch.com and www. bevinfostore.com.