The modern drinker is changing. With that come new trends that have been disruptive, while also providing opportunity for beverage retailers.

Consumers today want to know more about the history and production methods behind what they drink. And they enjoy experimenting across categories and styles. As a result, they are less brand-loyal than ever before. Drinkers tried a little of everything last year, causing alcohol trends to cross multiple categories.

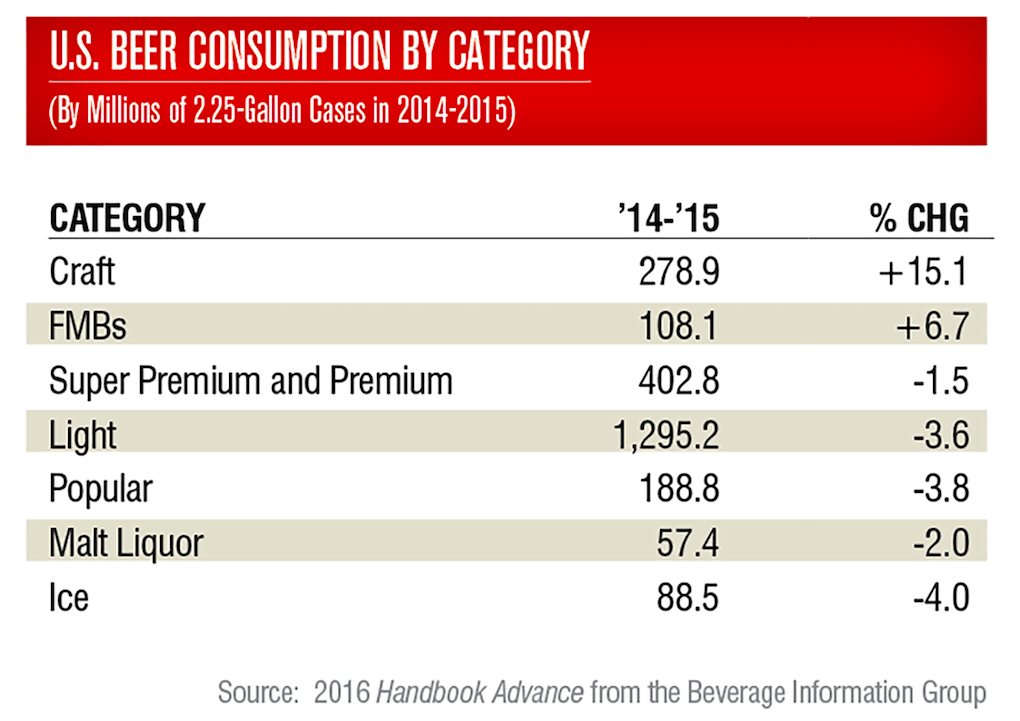

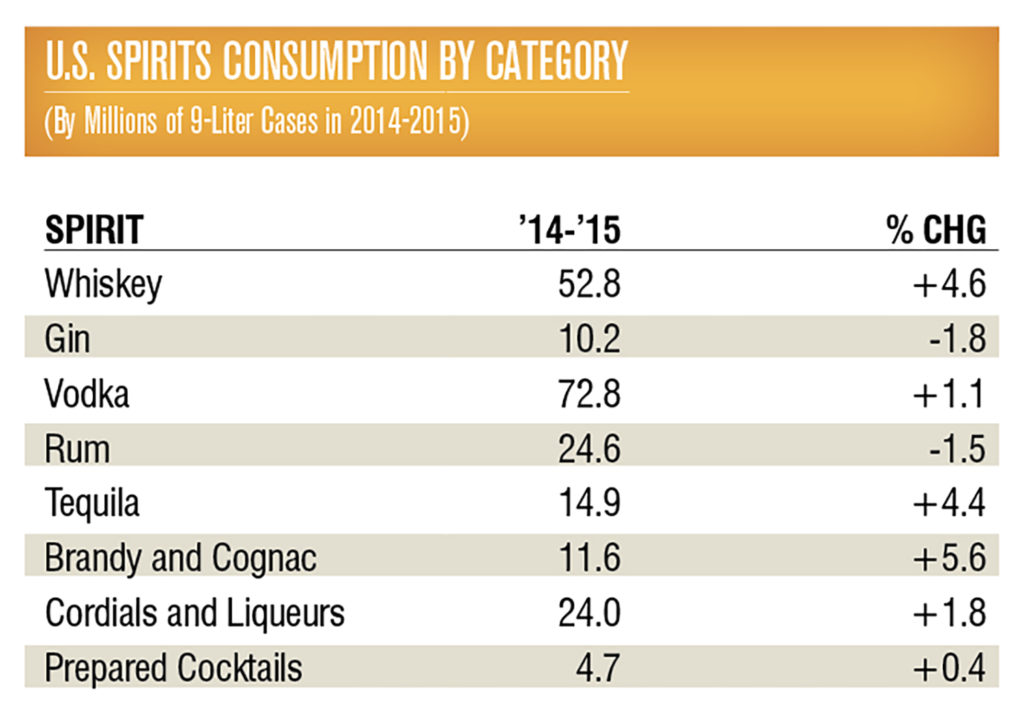

Certain categories did stand out in 2015 for having strong performances, in particular craft beer (14.1% growth last year, up to 276.5 million 2.25-gallon cases) and whiskey (up 4.6%, to 52.8 million 9-liter cases), according to the Beverage Information Group, our sister research company.

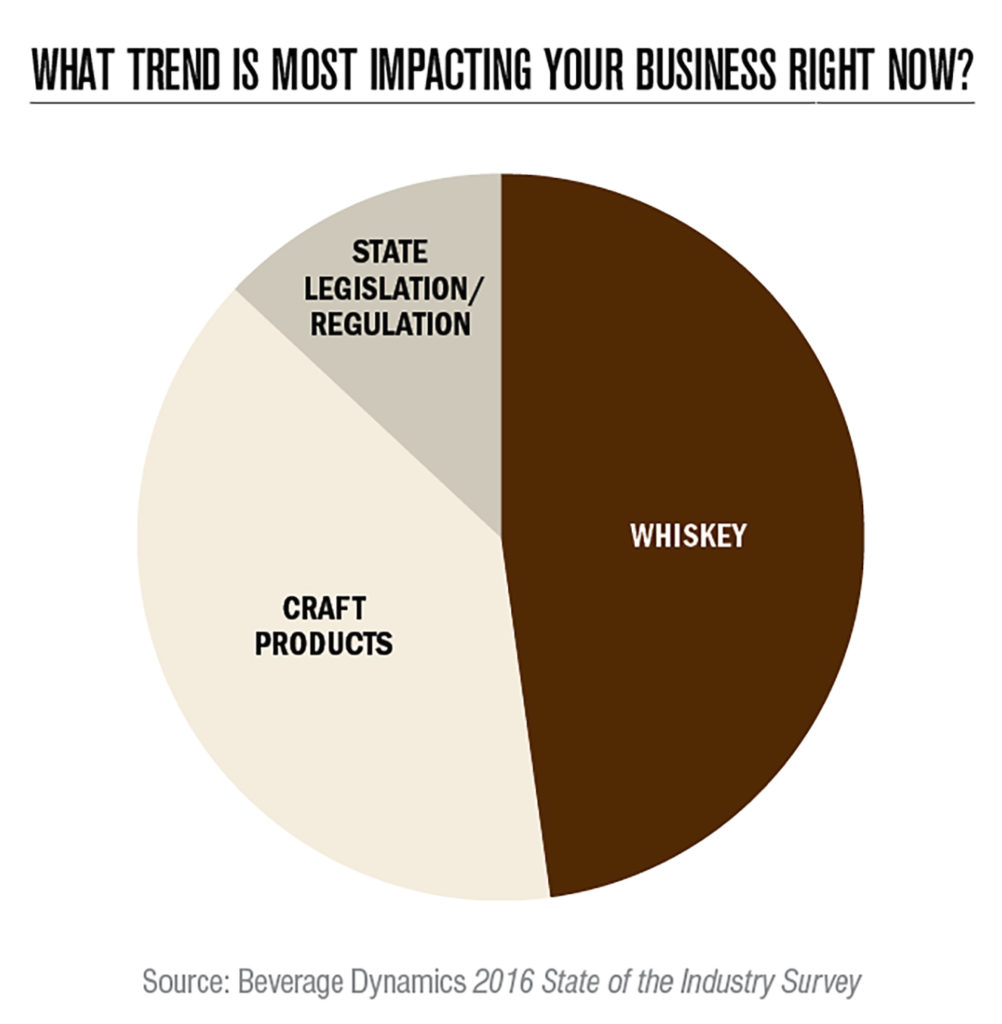

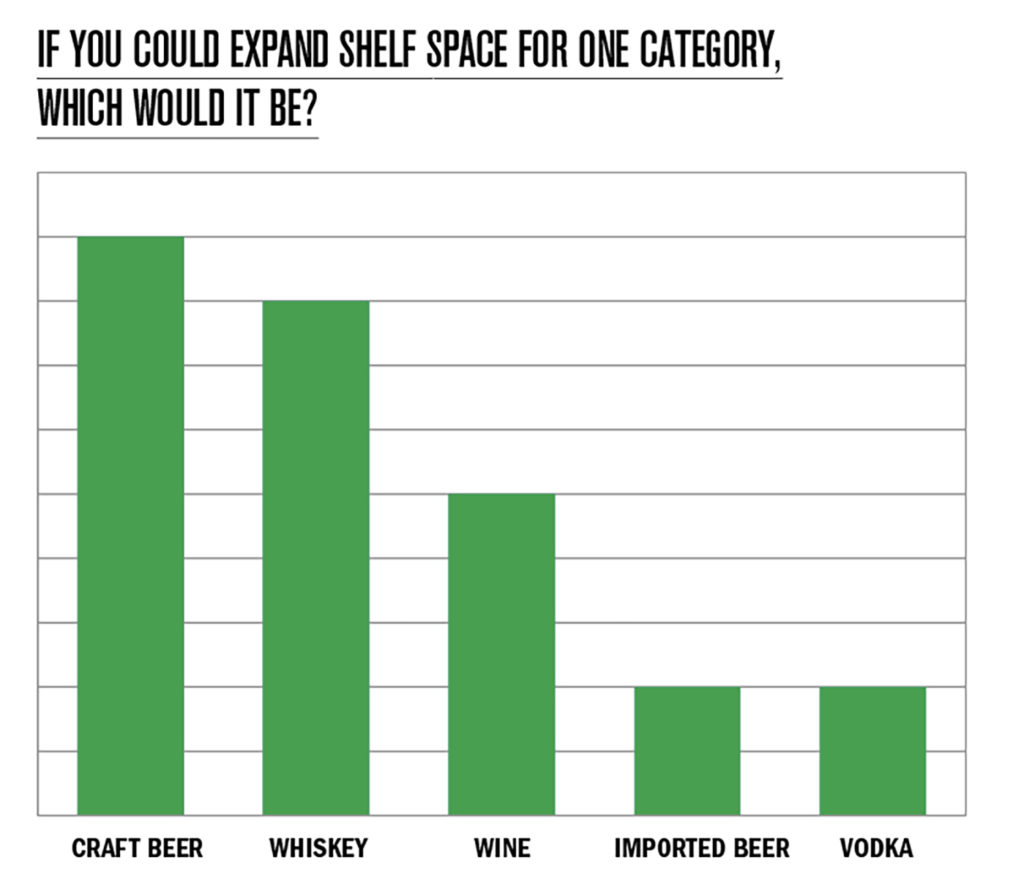

When we surveyed retailers on which categories need more shelf space, the top answers were craft beer and whiskey. This survey, sent out to our email newsletter subscribers, also asked which trends most impacted sales. Retailers reported whiskey and craft products above all others, once again.

It’s no wonder, since the last few years have seen an explosion in new microdistilleries and breweries opening across the country. Modern drinkers have developed a diverse, discerning palate for brown spirits and craft beer.

But two questions linger for craft beer. How much more can the category expand? And is it in or approaching a bubble? Whatever the answer, the craft beer boom has helped nurture interest in two other flourishing categories: hard ciders (up 9.6% to 30.8 million cases) and hard sodas (up 6.7%).

After whiskey and craft beer, the retailers surveyed were most eager to expand shelf space for wine. Helping sustain the wine category has been the recent rise of sparkling and premium bottles.

White spirits were a mixed bag last year. Vodka was relatively flat at +1.1% (to 72.8 million 9-liter cases), while rum dropped 1.5% to 24.7 million 9-liter cases. But tequila took off with a 4.4% gain in 2015.

Consumers see tequila less as an inexpensive shot and more as an elegant sipper on par with whiskey. Consequently, premium tequilas are coming to market in greater numbers.

We’ve combined our survey results with consumption and sales data from the Beverage Information Group to compile this list of category trends to keep a close eye on during the rest of 2016 and into 2017.

1) Whiskey Diversifies and Grows

Millennials love Bourbon, and are now drinking rye and Scotch. Whether as sippers or in cocktails, this new and growing appreciation for brown spirits has helped jumpstart America’s whiskey revival. And two newer trends have the category showing no signs of slowing down.

Millennials love Bourbon, and are now drinking rye and Scotch. Whether as sippers or in cocktails, this new and growing appreciation for brown spirits has helped jumpstart America’s whiskey revival. And two newer trends have the category showing no signs of slowing down.

The popularity of flavored whiskeys has spread at a blazing pace thanks to the tremendous success of Sazerac’s Fireball Cinnamon Whisky. This innovative, industry-altering spirit grew 65% in sales last year, to nearly 4 million cases.

“Fireball has replaced Jägermeister as the preferred shot of younger LDA consumers,” explains Marina Velez, senior product manager, data and insights, for The Beverage Information Group.

Fireball’s growth likely is capped by copycats. Jägermeister and Jack Daniel’s have already responded with spiced variants, along with many other spirits producers, big and small. This rise in cinnamon/spicy flavors has also coincided with the cooling off of sales for maple-flavored whiskeys, and sweeter Canadian whiskies in general.

Millennials in particular enjoy flavored whiskeys, as consumers who experiment. “People who drink flavored whiskey are statistically proven to be more adventurous in consuming other types of spirits as well,” Velez says.

The other red-hot trend right now in American whiskey hails from Ireland.

Irish whiskey has risen in sales, (up 8.2% in 2015) thanks in part to a broad demographic of consumers. Perhaps more so than any other segment within brown spirits, it counts women among loyal drinkers. Approximately 40% of Irish whiskey consumers are female.

Part of this owes to the spirit being sweeter and smoother than most other whiskeys. It’s a natural ingredient for craft cocktails.

Moreover, the category boasts one of the world’s top alcohol brands. Long established as a global giant, Jameson gained 17% in sales last year. The spirit contributes 76.3% of Irish whiskey sales worldwide.

Irish whiskey also possesses a strong and diverse premium segment that appeals to today’s craft drinkers. This includes Jameson caskmates, which finishes whiskey in barrels formerly used in aging craft beer. Millennials are the chief consumer target.

“Irish whiskey drinkers tend to skew younger than with other spirits, and are showing openness to exploration beyond standard entry-level blended Irish whiskies,” reports Velez.

2) Craft Beer: Boom or Bubble?

How much more can craft beer grow?

How much more can craft beer grow?

In 2014, this burgeoning category reached an 11% volume share of the overall beer industry. The Brewers Association (which claims to represent 70% of the brewing industry) believes that craft can grab a 20% volume share by 2020.

Is that achievable? “I think that’s a bit ambitious, actually,” Velez says. “I imagine [craft beer] is going to continue to grow, but the pace should be slowing.”

The main concern is market saturation. The number of breweries in America grew 19% last year to 3,464. How many more can open and remain profitable?

To craft’s defense, consumer appeal remains strong. Consumers like the “local feeling” of buying from nearby breweries. In 2015, regional breweries accounted for 77.8% of the craft beer industry’s production volume

Drinkers also enjoy the great variety of styles and flavors. The IPA craze that swept through America brought many new people into the category. From there they have explored through the numerous other styles — from porter to sour, from gose to Belgian, through experimental hops and beyond.

This desire for extensive experimentation has helped sustain the category and its many new breweries and beers. Of drinkers who purchased at least one beer per week, 22% bought more than 10 brands last year. Of craft drinkers in general, 33% more are willing to experiment across brands than those who prefer non-craft beer.

This desire for extensive experimentation has helped sustain the category and its many new breweries and beers. Of drinkers who purchased at least one beer per week, 22% bought more than 10 brands last year. Of craft drinkers in general, 33% more are willing to experiment across brands than those who prefer non-craft beer.

But at what point have consumers tried enough? Or is craft beer now so deeply rooted in American culture that we are still just scratching the surface of its potential?

The losers in that scenario would be the mainstream beer companies: Anheuser-Busch, MillerCoors and the like. They, in turn, have recently responded by investing in craft themselves. Big Beer has built out their own brands while buying up popular mid-level microbreweries like Elysium, Breckenridge and Four Peaks.

Will this blurring of lines between macro and micro help prevent a craft beer bubble? Much remains to be seen.

3) Wine Holds Strong

Wine sales rose 2% last year, up from a disappointing 0.7% in 2014. That 2014 figure came after gains of 2.1%, 1.9%, 3.1% and 2.1%, from 2013-2010.

Why the dip? The likely answer is that, as all Millennials reach legal drinking age, there are fewer purely wine drinkers. More consumers now experiment across categories, rather than remain dedicated to one. This change in consumer behavior has allowed beer and spirits sales to grow at a greater clip in recent years.

Which is not to forecast imminent decline for this category. Wine still has a bright future thanks to its loyal fans. These consumers increasingly skew younger and female, according to data presented earlier this year at the 11th Annual Wine Market Council Research Conference.

Millennials consumed 36% of all wine purchased last year, amounting to 159.6 million cases. This tops any other generation. Baby Boomers accounted for 114.1 million cases, Gen X 74.5 million, and over-69 consumers 31.6 million nine liter cases.

Millennials also drink 3.1 glasses of wine per occasion — compared to just 2.4 for Gen X and 1.9 for Baby Boomers.

And what wine people drink now tends towards premium. The top 20 U.S. premium-plus brands had a growth of 4% to 64.7 million nine liter cases last year. The average cost of table wines purchased in 2015 rose to $9.33, according to Wine Market Council data, up from $8 five years ago.

Prosecco, Rosé, red blends and Sauvignon Blanc were all best sellers in 2015, according to Wine Market Council findings. Sparkling wines in particular enjoyed robust sales last year.

Prosecco sales volume was up 34.3%, which helped lift the entire sparkling category to 11.7% growth.

Of customers who purchased Prosecco last year, 31% did not buy any sparkling wine in 2014. And 72% of Prosecco purchasers who had bought it before reported buying it in greater quantities in 2015.

Rosé enjoyed 31.8% growth in 2015. Even more promising, Rosés priced above $11 gained 59.9% in volume last year.

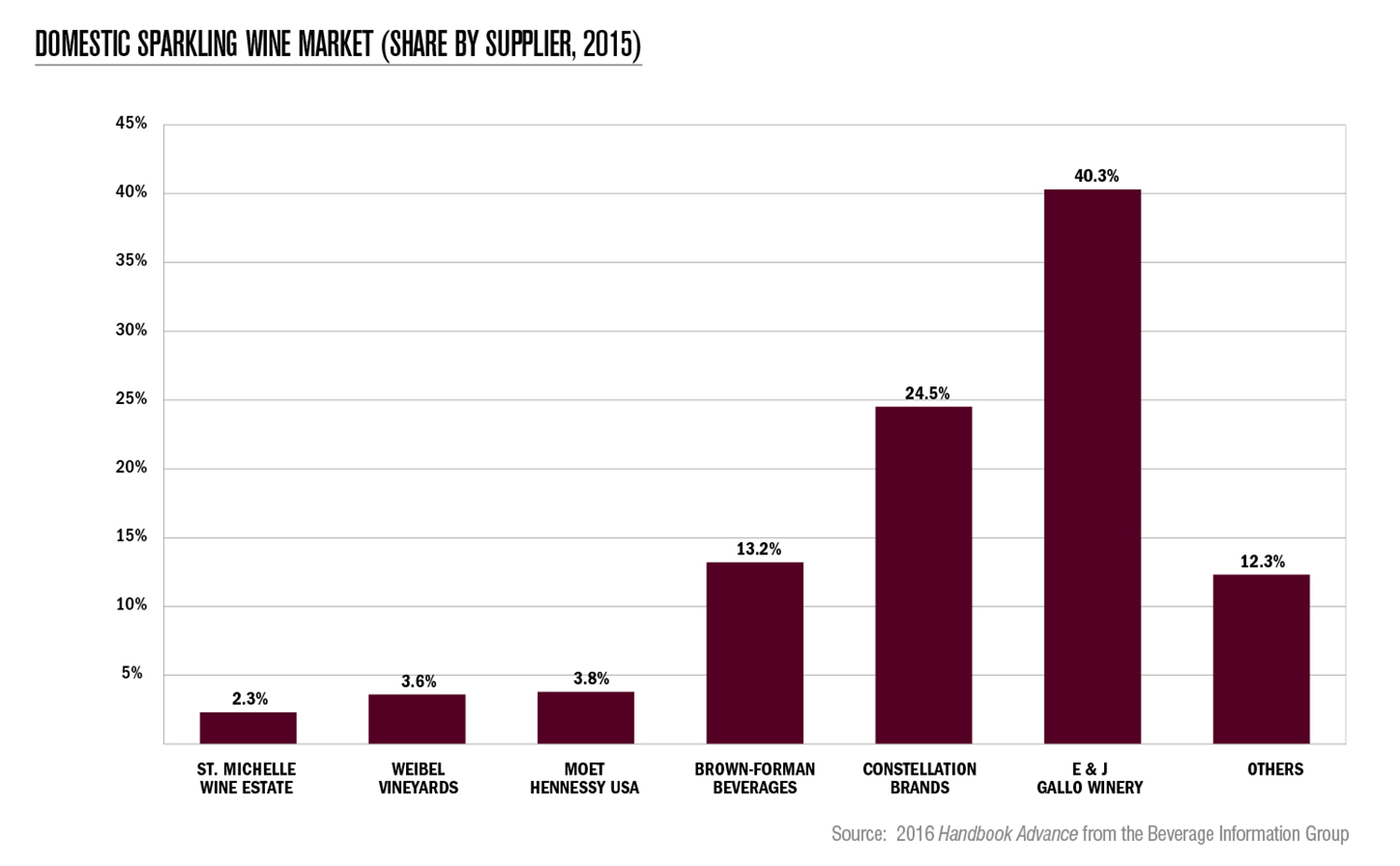

The good news about the sparkling boom: more consumers consider these wines to be every-day drinks, rather than just for holiday celebrations. The bad news is for U.S. wine companies, Velez says.

“Imported sparkling wines grew 6.6 percent to 7.1 million cases last year, while domestic brands were estimated to be stable at 8.85 million cases,” she points out.

4) Tequila’s Sunny Rise

It’s been said that all whiskey drinkers are tequila drinkers, they just don’t know it yet. Well, more consumers seem to realize it now.

It’s been said that all whiskey drinkers are tequila drinkers, they just don’t know it yet. Well, more consumers seem to realize it now.

Premium tequila is making a play for more shelf space. Image-conscious brands like Patrón and Casamigos have helped change consumer attitudes toward the Mexican spirit.

“They’re creating awareness that tequila isn’t just a party drink,” Velez explains. “They want consumers to see it as a drink you can pair with a meal like a wine or beer.”

And brands want consumers to think of top-shelf tequila the way they would of whiskey: as a spirit that can be poured neat and enjoyed as a sipper for its smoothness and complexity of flavors.

Millennials in particular have embraced tequila as a premium product. This is helped by the generation’s appreciation for all things craft. Many tequila brands (such as Patrón) have done an excellent job of highlighting the artisanal traditions and handmade qualities behind this ancient Mexican spirit.