The 2021 Wine Growth Brands Awards from StateWays magazine celebrate the fastest-growing and top-selling wine brands from the past year. These were bottles that attracted the most consumer attention while also defining category trends.

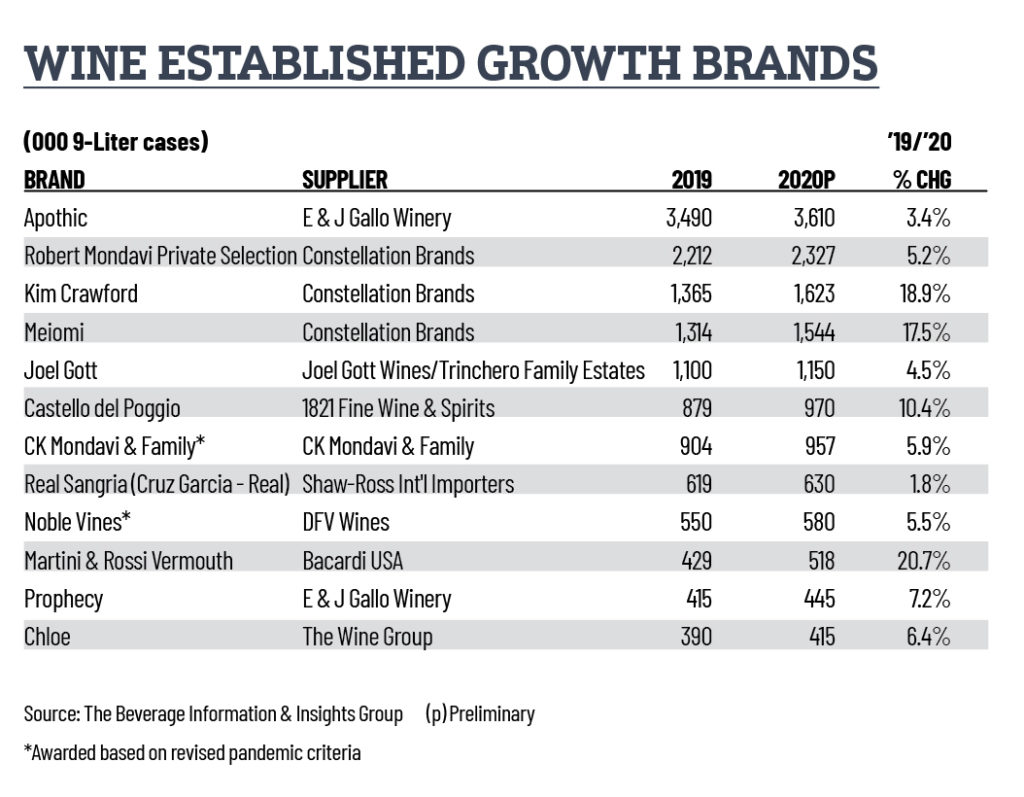

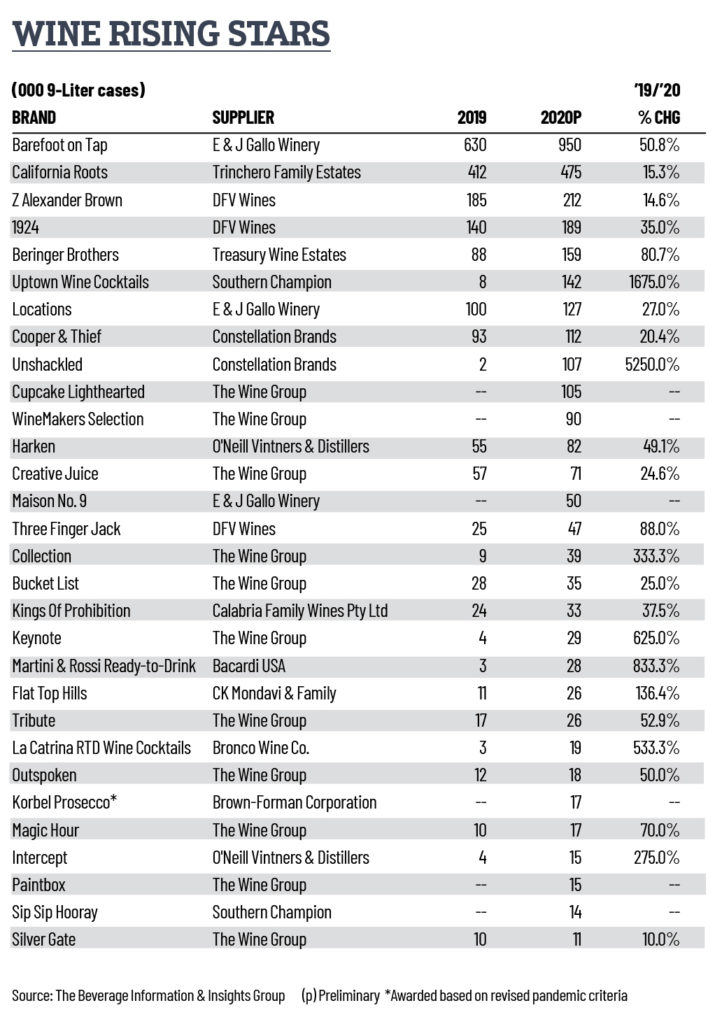

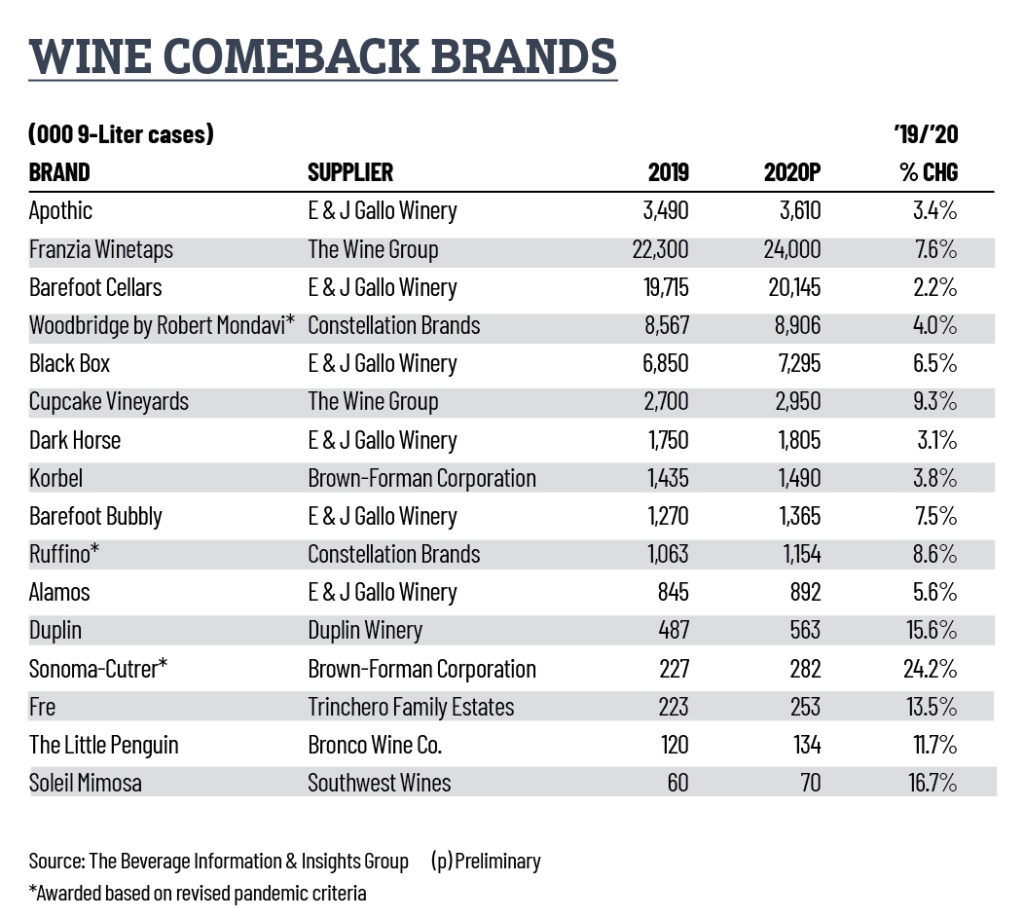

As always, our lists include the most innovative new brands, emerging stars, comeback stories and tried-and-true staples.

Growth Brands Wines That Shine

To say that 2020 was a rough year would be a massive understatement, but it was particularly rocky for people in the wine industry. Not only did they have to contend with the pandemic overall, with the business shutdowns and the decimation of the on-premise sales, they also endured several serious wildfires on the West Coast of the U.S., and got caught up in tariff wars.

Nonetheless, the turmoil brought on by Covid-19 actually seemed to improve wine sales. The Beverage Information and Insights Group projects that wine volume increased about 1% in 2020, vs. falling nearly 1% in 2019.

Many winemakers saw an increase in off-premise sales as the shelter-in-place rules took effect.

“Like all other wine brands, we clearly lost on-premise consumption,” says John Wardley, marketing vice president, Americas for Treasury Wine Estates, which won several Growth Brand Awards this year. “However, this was more than made up in our gains from off-premise growth and increased consumption at home.”

Treasury Wine Estates won a Rising Star for 19 Crimes, the line inspired by the convicts-turned-colonists who built Australia. The company was able to bring more consumers into the 19 Crimes franchise, Wardley says.

During Covid-19, shoppers spent less time shopping in-store, and gravitated towards brand names they know and trust, says Gary Heck, owner and president of Korbel Champagne Cellars. “So we put our best foot forward in the off-premise.”

Korbel California Champagne won a Comeback Brand Award, while Korbel prosecco won a Rising Star. It helps that Korbel has always been an off-premise-focused brand, Heck notes. But with the impacts of the pandemic, the company capitalized on this shift in consumer purchasing behavior by doubling down on its off-premise efforts.

“We listened to our retail partners and focused on making sure our basic principles were solid: our product variety and distribution, price, shelf and floor placement and promotions,” Heck says. “This allowed us to meet consumers where they were.”

Deutsch Family Wine & Spirits won a Fast Track award for Josh Cellars. Covid-19 initially drove a massive uptick in sales for wine and spirits, as consumers pantry loaded at first, and as the pandemic wore on, continued to increase their at-home consumption, says Tom Steffanci, president Deutsch Family Wine & Spirits.

“The wine growth was dominated by a small number of brands,” he says. Josh Cellars had significant benefit because of the high regard consumers have for the brand, its strong consumer awareness and quality, Steffanci notes. The brand is up more than 42% in dollar sales during the last 12 months, “which is twice as fast as it was growing pre-pandemic.”

The fastest-growing wine was BeatBox Beverages, a bag-in-box wine punch from Future Proof, up a whopping 84.3%.

“It’s great to see more and more retailers capitalize on the energy and excitement consumers have for our brand,” says Co-founder Brad Schultz. “While it’s nice to be recognized as number one in back to back years, we feel like we’re just getting started.”

Shiny Bubbles

Sparkling wines, including prosecco, have been on the upward trajectory for a number of years, says Heck. “Much of that has been due to its light, small bubbles, affordable price points and the perception that it is now more of an ‘everyday’ consumption beverage. With the impacts of Covid-19, consumers took to shopping Korbel and other sparkling wine brands in the off-premise and celebrating small, everyday moments at home.”

Another broad industry trend that has benefited Korbel is the explosive growth of rosé, Heck says. “With two of the leading sparkling rosé products in the category, Korbel Brut Rosé and Korbel Sweet Rosé, we are well positioned to tap into this trend by providing a sparkling wine that is right for this consumer.”

What’s more, the Prosecco DOC Consortium last year approved a Prosecco DOC Rosé, and pink proseccos began hitting the market in late 2020. Comeback Brand winner Cupcake Vineyards and Established Growth Brand recipient Chloe Wine in January released their prosecco rosés.

“Earlier this year, we were among the first wine brands to introduce prosecco rosé, following Italy’s move to add the classification,” says Steffanci. He believes Josh Cellars is well poised to win the prosecco rosé segment, with its strong built-in consumer base and success with other varietals, including prosecco, which it launched just over a year ago. Josh Prosecco is now the fastest-growing, and fourth largest prosecco in the U.S., Steffanci says.

Snoop There It Is

A number of wine brands have partnered with star power in the past few years, “and with the growth of celebrity endorsed/owned wines, there has been a significant increase in consumer engagement,” says TWE’s Wardley. 19 Crimes in April 2020 announced a partnership with rap star/entertainer Snoop Dogg on a California wine called Snoop Cali Red.

“Some brands have leveraged their celebrity connection far better than others,” Wardley says. “19 Crimes’ partnership with Snoop is arguably the most overt, given he is front and center on the package and central to the augmented reality experience” that the brand’s labels incorporate.

The launch of 19 Crimes Cali Red helped fuel momentum on the base brand, as more consumers became aware of 19 Crimes, he notes. The first California bottling from the Australian wine brand, Snoop Cali Red is a blend of Lodi-sourced petite syrah (65%), zinfandel (30%) and merlot (5%).

Snoop Dogg and 19 Crimes unveiled Snoop Cali Rosé, a blend of grenache and zinfandel, in March 2021. “The recent launch of Cali Rosé will also attract even more consumers to the 19 Crimes franchise,” says Wardley.

Growth Brands and Great Expectations

While the pandemic put a crimp in spending for many consumers, others opted to spend a little more on wine since they were stuck at home. Or if they did go out, they may have selected a better wine by the glass or bottle.

“Consumers continue to trade up and have high expectations of the brands they choose,” says Alex Wagner, vice president of communications for the Wine & Spirits Division of Constellation Brands, which won a number of Wine Growth Brands this year. “Overall, people are willing to spend more on each wine they purchase and expect high quality, great flavor profile and a compelling and engaging brand narrative.”

This industry trend aligns well with Constellation’s The Prisoner Wine Co., which earned a Fast Track award, she says. “The portfolio sits within the luxury category; however, with an approachable tasting profile and consumer proposition that’s perfect for the budding consumer, coupled with a layered complexity that is sure to please the established enthusiast.”

Constellation in 2020 expanded The Prisoner label with the addition of The Prisoner Cabernet Sauvignon and The Prisoner Chardonnay, which now accompany the flagship Red Blend. “To introduce these exciting new wines, and support the local hospitality industry during this challenging time, we partnered with Saturday Night Live’s Chloe Fineman, and executed a delivery program in New York and nationally with Drizly in the fall,” Wagner says.

E. & J. Gallo, which recently completed the acquisition of more than 30 wine brands from Constellation Brands, also won several growth brands this year, including a Rising Star for Locations. The brand, launched by star winemaker Dave Phinney as a way to showcase wine regions around the world, was acquired by Gallo in 2018. Priced at about $20 a bottle, Locations offers high quality at a good value.

CK Mondavi & Family in summer 2019 released Flat Top Hills, described as a modern line built on four generations of winemaking history. The brand, which boasts wines with bold flavors, distinctive fruit-forward style and sleek design, won a Rising Star Award, while CK Mondavi & Family wines took an Established Growth Brand.

Looking Ahead

As the Covid-19 crisis hopefully subsides this year, winemakers are optimistic about the future. And what they’ve learned during the unprecedented pandemic period will serve them well in meeting new business challenges.

“As we all navigated a fluid situation,” Wagner says, “we pivoted with rapidly changing consumer trends and shifted our efforts to a digital/DTC-driven format to ensure consumers and our wine club members could still engage with the brand while in lockdown.”

At The Prisoner Wine Co. Tasting Lounge in Napa Valley, “we pivoted our tastings as needed in order to welcome back visitors in a way that was safe and enjoyable for both staff and patrons,” she notes. “The team worked tirelessly to adjust seating arrangements and safety protocols.”

While Covid-19 has left many people unemployed and uncertain about the future, Korbel has benefitted from its affordable price points, multiple different varietals and a variety of packaging sizes, Heck says. The company released Korbel Prosecco in 187-ml. bottles this past November.

For Josh Cellars, the brand’s advertising has become a key factor in driving increased buyer penetration and sales volume, Steffanci says. “Paid media has become a core short- and long-term growth driver, especially in the off-premise.”

Knowing consumers would spend more time online, “we decided quickly to invest significantly more in 2020 to drive awareness and brand equity using digital and social advertising, which make up the majority of our advertising investment,” he notes. Josh Cellars also has a consistent presence on Hulu and other full episode players such as CBS and NBC, YouTube, programmatic online video and Facebook/Instagram.

Covid has changed the way that consumers shop for wine, Steffanci says. “Unplanned shopping trips are down, and people spend less time in stores than they used to. As a result, it’s become more important than ever to reach consumers online while they are planning their shopping, and then again when they enter the store or visit a website to purchase.”

As for the on-premise channel, which has been severely impacted by Covid given the widespread closures and restrictions, “restaurants and bars will come back strong,” Steffanci predicts. “We’re committed to rebuilding Josh’s on-premise presence, as the channel is now beginning to come back strong in most markets.”

In particular, Josh is investing to drive by-the-glass menu placements, he notes. “We retained our sales personnel and we are reinstating our budgets, so while others are pulling back, we will be there to provide support.”

Melissa Dowling is editor of Cheers magazine, our on-premise sister publication. Contact her at mdowling@epgmediallc.com.