There seems to be no stopping tequila, or agave spirits in general, for that matter. Interest in the category and the resulting boom in sales continue to drive growth, as consumers search for more premium offerings and look to broaden their drinking horizons to other agave-based beverages.

“Tequila is the number-one increasing category for us over the last five years,” says Tom Agnes, liquor operations manager for Brooklyn Center Liquor in Brooklyn Center, MN, a city-operated, multi-unit chain. “A much bigger category is vodka, but from a percentage sales increase, tequila by far is beating any other category for us.”

Daniel Grajewski, beverage director for the 50 Eggs Hospitality Group, agrees. “Really for the first time, there’s starting to be competitors to vodka, and that is namely the agave category,” he says.

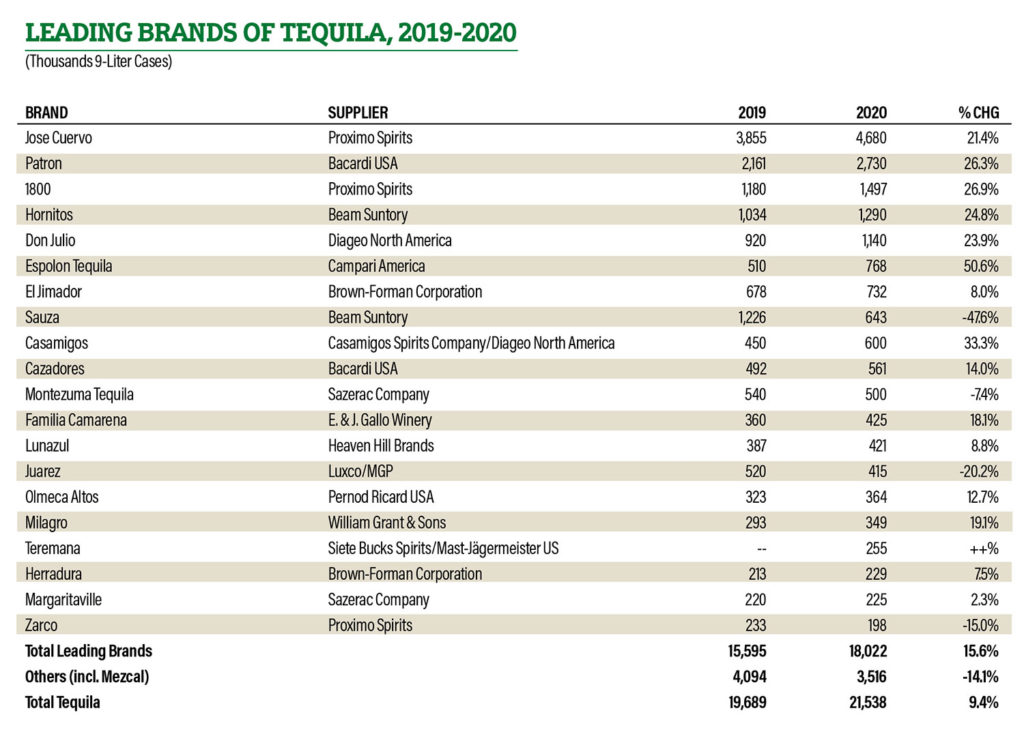

Tequila increased 9.4% in 2020 to 21.5 million 9-liter cases, according to the Beverage Information Group’s 2021 Liquor Handbook. The total leading brands were up more than 15%.

The category continued its growth spurt on the Drizly delivery platform in 2021, and the company believes the trend will likely accelerate in 2022. In fact, 80% of respondents in Drizly’s annual retailer survey said they plan to carry more tequila in 2022. Tequila saw a 13% increase in share year-over-year in 2021 on Drizly, and now commands an 18% share of the liquor category specifically.

“The category’s ascent has been fueled by a convergence of many factors Ñ and boosted during the pandemic,” says Liz Paquette, Drizly’s head of consumer Insights. “Premiumization of the tequila category is a larger driver, led by growth in the reposado and añejo categories as more and more high-quality brands enter the space. Celebrity brands have also helped to bring more awareness to the category outside of normal occasions.”

Tequila’s popularity has also been fueled by more consumers making cocktails at home during the pandemic. But Agnes says he has also noticed a shift beyond the demand for cheaper tequilas to mix Margaritas at home.

“They are exploring higher-end offerings instead of just grabbing silver and mixing up Margaritas,” he says. “I think they’re definitely moving towards more of a sipping product than a mixed product.”

To differentiate itself from other retailers, Minnesota Municipal Liquor has partnered with Patrón, El Tosoro and Herradura for its own single barrel offerings. “It’s big with bourbons,” Agnes says of the trend, but tequilas are starting to offer single barrel picks as well. Each barrel is marked “Hand Picked for Minnesota Municipal Liquor” to communicate their exclusivity.

Chris Ciskey, owner of Yankee Wine & Spirits in Newtown, CT, has also observed a shift to more premium tequilas. “We’ve seen a really big uptick in premium brands, like Clase Azul, the high-end sipping tequilas,” he says.

Tequila Benefits from Bourbon Burnout?

Elizabeth Gregg, general manager of Applejack Wine & Spirits in Wheat Ridge, CO, has a theory about what’s behind the premiumization trend. “I think we’re starting to see a little bit of a bourbon burnout,” she says.

A lot of bourbons are hard to get nowadays, “and you’re seeing that customer starting to try different things,” Gregg notes. “I think they’re very surprised when they get over to the tequila aisle about how great the flavor profiles are, and that some tequilas are coming out that have a tilt towards a bourbon taste to them.”

At the same time, new products have generated additional interest in the category. For instance, Hotaling & Co. in May 2021 launched Severo Tequila.

“We are noticing an increase in consumer awareness, attention and seeking out agave,” says Laura Kanzler, Hotaling’s regional sales manager. “They’ve tried a lot of whiskeys, they’ve experienced what that is, and now they’re looking for other unique experiences.”

In September 2021, Proximo Spirits’ Maestro Dobel brand launched Pavito, a limited-run Pechuga tequila. The blanco tequila is infused with turkey breast, Mexican seasonal fruits and spices, which lend sweet and savory notes, says Jaime Salas, Proximo’s head of advocacy Ð agave. Proximo also unveiled one of the first tequila-based hard seltzers, Jose Cuervo Playamar, in spring 2021.

Beyond the ‘Rita with Tequila

Margaritas remain the top cocktail in most markets, but other tequila drinks, craft and classic, are gaining ground. One is ranch water, a simple blend of tequila or mezcal, a squeeze of lime and Topo Chico or other sparkling water. Its roots are in West Texas, where it’s been a favorite of cattle ranchers.

Big Star in Chicago offers its own House Ranch Water made with El Tosoro tequila, Topo Chico (though its high-traffic location near Wrigley Field uses a carbonation machine), lime juice and a dash of orange bitters, with a grapefruit peel expressed on top. Bar director Laurent Schroeder-Lebec says it’s been a huge hit with customers.

When Big Star started selling its ranch water, which is priced at $11, bartenders told him “This is wild. We kind of have a competitor to the Margarita. People want these things so much,” Schroeder-Lebec says. “You don’t get too many moments like that.”

At The Whistler in Chicago, the goal is to serve some liquid heat, especially during the winter. Fitting the bill is its popular Raspberry Beret ($13), made with blanco tequila, dry vermouth, egg white, raspberry syrup, lemon and habanero tincture.

“If you put spicy in tequila on a menu, it’s going to sell,” says Alex Barbatsis, head bartender at The Whistler. “People like that comforting flavor profile.”

At 50 Eggs Hospitality Group’s Chica concept in Aspen, CO, tequila cocktails include the signature Chica-Rita, with El Tesoro Blanco tequila, pineapple, lime, agave and Tiki bitters, and the Palomita, made with Avión Blanco tequila, pink grapefruit, agave and lime.

Mezcal’s Momentum

Mezcal is also climbing in popularity. “We’re selling more mezcal than we used to,” says Ciskey of Yankee Wine & Spirits.

Whisler’s, a bar in Austin, TX, includes a smaller speakeasy-style mezcalera upstairs called Tobal‡ that holds about 20 people. At any given time, the bar has 220 to 250 different varietals of mezcal. The top-selling mezcal brands are Del Maguey Chichicapa followed by Montelobos Espadin and then Vago Elote.

They also offer their own mezcal from a partnership with Gusto Histórico, and charge $18 a pour for it Ñin line with their other offerings. “It’s really just a cool thing to be able to have something that nobody else has,” says General Manager Matthew Wenger.

Wenger is seeing a trend of mixing mezcal into classic cocktails. “It just kind of enhances the flavor the classic cocktail, it puts a little twist on them,” he says.

Cutting the mezcal in a drink with tequila is another trend. “So, it’s usually like a 2/3 mezcal, 1/3 tequila split, and it kind of cuts down some of that smokiness to balance out cocktails,” Wenger explains.

With mezcal cocktails, it’s important to keep their range of flavors from getting lost, says Grajewski of 50 Eggs Hospitality. “I look to highlight the agave flavor, and not the smoke,” he says.

“Everybody assumes mezcal is smoky, and that’s not always the case,” he adds. “In fact, I think it’s the exception. It has beautiful grassy flavors, wonderful tropical flavors.” His Mexican Hot Chocolate at Chica is made with Espadín mezcal, guajillo chili and toasted marshmallow.

TTT Clarendon, Street Guys Hospitality’s Mexican-inspired restaurant in the Arlington, VA, area, features a Cidra Sangria made with white wine, mezcal, cider simple syrup, apple cider and spices. The El Jolly is made with mezcal, coffee-infused tequila, vermouth and orange bitters.

It also offers a Pomegranate Paloma with silver tequila, pomegranate-grapefruit seltzer and lime. Drinks range in price from $12 to $14.

Customers are in the discovery stage, frequently inquiring about the agave flavors in these cocktails, says Can Coskunkal, Street Guys’ director of operations “Then we try to educate them as much as we can about mezcal and sotol,” he says.

Gracia in Seattle stocks more than 100 tequilas, 100-plus mezcals and about 30 different agave distillates such as raicilla and bacanora. Bar manager Kyle Hestead says he’s proudest of the La Luna Roja cocktail, a mezcal Negroni with Montelobos Espadín and Ancho Reyes chili liqueur, and the Levanta Muertos, which is a play on a Corpse Reviver number 2 with Sotol Por Siempre and XTA, a Mayan honey-anise liqueur.

The specialty cocktails are priced in the $11 to $16 range. “We are also using Margaritas as a fast and cost-effective way to float the program so we can reduce prices on some of our more expensive agave spirits,” Hestead says.

At Lazy Tiger in St. Louis, beverage director/co-owner Tim Wiggins discovered the allure of raicilla while doing a deep dive into agave spirits. Raicilla appears on a quarter of the Lazy Tiger cocktail menu.

For instance, The St. Louis Catholic stirred cocktail features Mexicat raicilla, Zucca amaro, Cynar 70, sweet vermouth and Cape Verde Island rhums. The Whisper Cup, a take on Mexican Hot Chocolate as a flip, uses La Venenosa raicilla, green chartreuse, sweet vermouth, Mexican Angostura, cinnamon, whole egg and chocolate meringue on top. “People are craving that earthy, smoky flavor of agave spirit,” Wiggins says.

Sustainability, Supply Chain Concerns

The tequila category has not been without its share of challenges, however. For one thing, like many other products, it has been experiencing widespread supply chain disruptions during the pandemic, creating shortages that have become quite acute in different parts of the country.

“We’ve probably got more holes in our tequila section than any other section in the store. Over the last two years there’s been a massive shortage,” says Brooklyn Center Liquor’s Agnes. “We just are having a hard time sourcing them. And when we do get product in, it’s gone right away.”

Hestead agrees. “The supply chain issues have been so constant that we’ve gotten pretty used to having a big portion of our bar be out of stock.” Tequila añejo is especially hard to come by, he notes, as it’s all sitting in barrels aging.

But there are also more existential concerns about the category’s ability to keep up with all the demand. Some are worried the rush for profits and industrialization is threatening the way of life for many of the small traditional agave producers.

Proximo Spirits in 2019 announced The Agave Project, an initiative that “spearheads Jose Cuervo’s long-term commitment to agave, as well as the people and land of Tequila, Mexico,” says Salas. “At Jose Cuervo, we’re continuing to identify solutions to create a better, more sustainable future for agave. We’ve already introduced biodegradable agave-based straws at scale through The Agave Project, and are excited for what’s ahead as we look for new ways to repurpose the agave plant.”

Sustainable production remains an important issue for Big Star’s Schroeder-Lebec, who welcomes more of this conversation. “I think the name of the game in 2021 and ’22 seems to be a lot more transparency across production,” he says. “It’s really great to see that be the dialog.”

Feature image by Dylan Freedom on Unsplash.

Andrew Kaplan is a Queens, NY-based writer who covers the beverage industry.