The Growth Brands Awards are an annual program that determines and celebrates the fastest-growing and top-selling spirits, wines and beers in the U.S. These beverage alcohol brands fuel modern trends while maintaining consumer loyalty.

Which products pulled off these tough tasks in the past year? 2022 saw an industry in transition. Covid-19 receded, inflation flared, a mini-recession ensued and on-premise accounts continued to come back from disastrous lockdowns. Trends have shifted. Some consumer preferences formed during the pandemic have faded, while others are still gaining steam.

Premiumization Leads

Neither a pandemic nor an inflation-fueled recession can keep consumers from trading up in alcohol brands. Reliably, spirits remain a category where people are willing to splurge on affordable luxuries. Customers gravitate towards these products, bolstering a great number of Growth Brands Awards winners.

Rising Star Cooper’s Craft “is being driven by consumers’ interest in premium bourbon,” says Laura Petry, Brand Director, Emerging Brands, Brown-Forman. “Coopers’ Craft Barrel Reserve is aged in chiseled and charred American White Oak barrels that deepen the whiskey’s wood exposure, creating a robust and complex taste profile.”

Quality, production and provenance are among the most commonly given characteristics for Growth Brands Awards winners.

“Smoke Lab Vodka has strong consumer appeal because it is the first premium vodka imported from India, and it is made from locally sourced basmati rice and pure Himalayan spring water,” says Mike Ginley, President, NV Group USA. This Rising Star is “five times distilled, gluten free, vegan and made in India’s first zero-carbon-footprint distillery.”

Differentiating in the vodka category is difficult. Premiumization helps.

“What sets Broken Shed apart from other vodkas and continues to drive sales is what we leave out: zero additives, sweeteners or GMOs; plus Broken Shed Vodka is gluten-free from start to finish,” says Jean-Marie Heins, Chief Marketing Officer at Broken Shed Vodka. “Whey gives Broken Shed its unique, crisp, clean taste that people love. To be recognized as a Rising Star brand in the world’s largest market is a clear indicator of how many people are craving sustainable ingredients and naturally delicious flavors for their cocktails.”

In today’s age of hyper-informed consumers who research everything online constantly, brands cannot fake much.

“Consumers can see through a mediocre product, even if that product has an award-winning marketing strategy behind it,” says David Dreyer, Chief Marketing Officer of Starco Brands, maker of Rising Star Whipshots.

Perhaps the category where premiumization is the most pronounced is American whiskey. Our modern bourbon boom has been driven in large part by consumers whose eyes have shifted from the bottom and middle shelves to the top.

“In February 2022, we introduced Angel’s Envy Rye Whiskey Finished in Ice Cider Casks as the fourth release in our Cellar Collection,” says Gigi DaDan, General Manager for Fast Track Award winner Angel’s Envy. “This first-of-its-kind whiskey was created by finishing seven-year-old, 95% rye for 364 days in ice cider casks from Vermont-based Eden Specialty Ciders.”

“Our Master Distiller Owen Martin, who joined the team in October, embodies Angel’s Envy innovative mindset; he will be critical in bringing a fresh perspective to the category,” she adds. “In the coming years, we’re looking forward to continuing our award-winning cask strength and special release programs with Owen at the helm.”

Whiskey brands hold onto consumer attention, amid our daily bombardment of information and distractions, through these innovative releases.

“In September 2022, [Wild Turkey] unveiled the limited-edition Master’s Keep Unforgotten, the seventh offering in this annual release,” says Mark Watson at Campari, U.S. Marketing Director of Dark Spirits Portfolio. “The Master’s Keep series was first launched in 2015 with Master’s Keep Aged 17 Years, and was inspired by Eddie Russel’s desire to create something that enabled him to experiment with aging techniques and finishes. Master’s Keep Unforgotten is a blend of 13-year-old bourbon and eight-to-nine-year-old rye whiskey that is bottled at 105 proof.”

Wild Turkey won an Established Growth Brand this year, its 15th award overall, gaining entrance into our Growth Brands Hall of Fame.

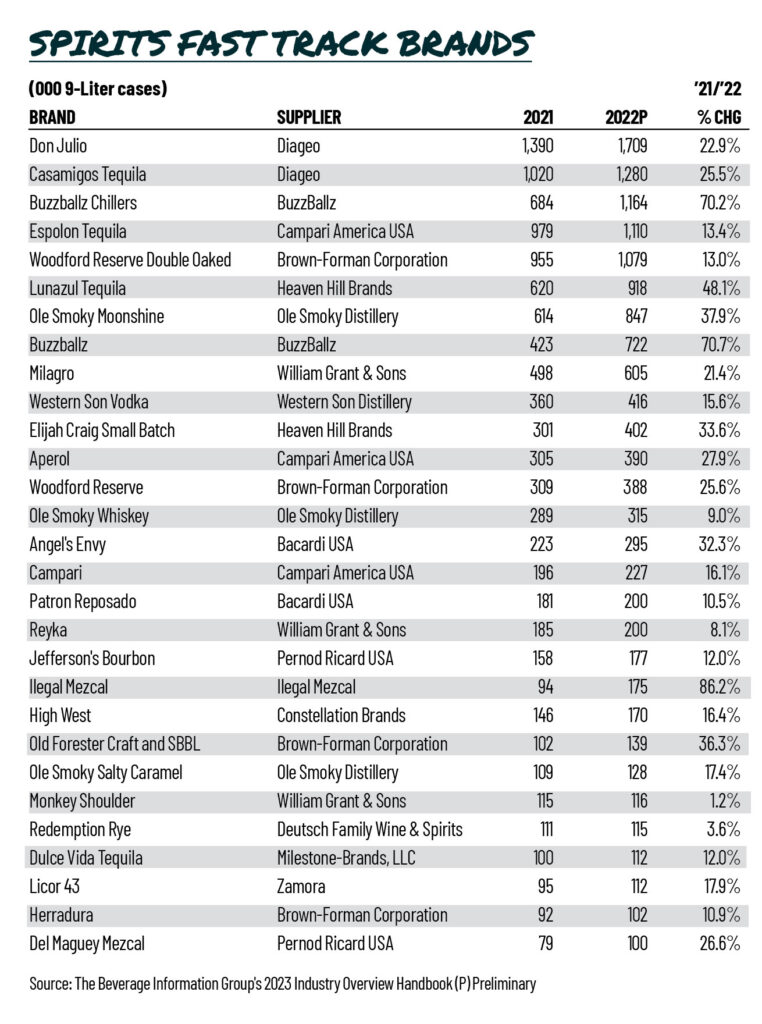

Tequila Remains Red Hot

Another category where premiumization stands out is tequila. Consumers no longer think of agave spirits as the cheap stuff behind blurry college nights, but as top-shelf sippers or craft cocktail ingredients.

“We are in the midst of a tequila boom and have benefited from the overall growth of the category,” says Lander Otegui, SVP of Marketing at Proximo Spirits, producer of Established Growth Brand Jose Cuervo. “Tequila is one of the fastest-growing spirits globally, and experts anticipate this growth to continue into the next decade. In fact, according to IWSR, tequila recently overtook whiskey to become the second most valuable spirit in the United States, and it is set to surpass vodka by the end of 2023.”

“For one, our latest expression release, Cuervo Tradicional Cristalino, garnered fast fans in 2022,” he adds. “Entering the Cristalino category was an exciting venture for the brand, as the cristalino category is the fastest-growing tequila segment in the U.S., with a growth rate four times higher than the tequila category at large. We released our Cuervo Tradicional cristalino as an entry-level premium offering to introduce young spirits drinkers to this bright and versatile expression. We found that the expression’s approachable premiumization was highly appealing as this level of luxury was a largely untapped space in the industry.”

Many tequila brands have benefitted similarly.

Fast Track winner Herradura is a “high-quality tequila that’s positioned for growth within the super-premium segment, where many consumers are experiencing tequila moments,” says Jesus Ostos, Brand Director, Tequilas, Brown-Forman.

As such, innovations have begun to emerge in this historic category at a rapid clip.

Fast Track winner Don Julio recently released Tequila Don Julio Rosado. This tequila “aged at least four months in Ruby Port wine casks from the Douro wine region of Portugal, which imparts a delicate pink hue and light fruit finish,” says Christina Choi, Senior Vice President Tequila, Diageo North America.

“We also released the second bottling of the extremely rare Tequila Don Julio Ultima Reserva, an exceptional 36-month aged extra a–ejo that preserves Don Julio Gonzalez’s ultimate legacy, the final agave harvest that he and his family planted in 2006,” she adds. “Lastly, we celebrated the return of the limited-edition Tequila Don Julio Primavera, which takes the brand’s traditional Reposado and finishes it in European casks that previously held wine infused with macerated orange peel. As we bring new offerings to the market, we hope that will in turn bring more adult drinkers into our family.”

Estate releases have become more common as a premium tequila line extension.

Tequila Cazadores 100 Year Estate Release is a “limited-edition reposado created to honor the legacy that became Tequila Cazadores, crafted with agave grown and matured on our property in Los Altos de Jalisco,” says Jay Needham, Brand Director for this Established Growth Brand.

The product that helped popularize the concept of premium tequila, multiple Growth Brand Award winner Patrón, continues to innovate.

“This year, Patrón entered the prestige category of tequilas, elevating the standards of that category with the release of Patrón El Alto, says D-J Hageman, Vice President of Marketing, North America — Patrón Tequila. “Patrón El Alto is primarily composed of extra anejo — aged for four years to achieve maximum potential — and accompanied with anejo and reposado. Patrón El Alto is an exceptional entrant into prestige, a segment that consumers gravitate toward as its forecasted to double in size by 2025.”

Brands with Values

Consumers today, especially younger LDA generations, gravitate towards brands whose values they share. Accordingly, perceptive companies have matched quality products with worthy causes.

“We’re launching a new campaign in partnership with [Fast Track winner] BuzzBalls, aptly named ‘Whip the Ballz’, in celebration of Testicular Cancer Awareness Month,” says Dreyer, of Whipshots. “We’re firmly committed to using our platform to bring awareness to causes that don’t traditionally receive support from commercial brands. That’s why Whipshots is partnering with the Testicular Cancer Awareness Foundation to support those fighting testicular cancer and remind others to get checked.”

Rising Star Uncle Nearest is named for and directly benefits the ancestors of the first African American master distiller on record in the U.S. It’s also a Black-owned and woman-run company.

“When [consumers] see we are also the fastest-growing and most successful Black-owned spirit brand, they are more than intrigued,” says Katharine Jerkens, Chief Business Officer at Uncle Nearest. “Top that off with the history of the namesake of our brand, and the story of how this brand was built, and you have consumers calling for it by name wherever they go.”

Elsewhere, as part of Broken Shed Vodka’s annual Veteran’s Day promotion, the brand partners with Help Our Military Heroes (HOMH), a nonprofit organization benefiting active-duty military and veterans.

“Broken Shed Vodka donated $1 for every 750-ml. equivalent bottle purchased during the months of October and November by any on- or off-premise U.S. account to HOMH,” Heins says. “As a result, November 2022 was the second highest sales month in Broken Shed Vodka’s history, largely due to the integrated HOMH initiative across Broken Shed’s social channels, website, point of sale, enewsletter and more.”

Digital Domain

A world that was already shifting online only hastened its digital transformation during the sheltering periods of the pandemic. More than ever, the internet informs our thoughts. Brands have plugged in.

Established Growth Brand Crown Royal Peach’s social content has “exceptional performance on Instagram and Pinterest, surpassing program benchmarks by over 20% and receiving strong organic engagement rates from consumers, further demonstrating the brand’s strong resonance with the at-home host,” says Sophie Kelly, SVP Whiskeys, Diageo.

This was a common refrain among Growth Brand Winners: digital equals growth.

In the past year, Rising Star Mozart Chocolate Liqueur employed “a strong focus on digital and print media in both trade and consumer worlds,” says Jenny Manger, Marketing Director, Marussia Beverages USA. This included “working with social influencers in the chocolate world and mixology world, gaining visibility and consumer awareness.”

Many brands funneled advertising dollars into the digital arena.

“Pursuant to a successful 2022 test, we are investing heavily in digital marketing, including paid and organic social media,” says José Chao, President and CEO of Rising Star Coppa Cocktails.

At Southern Champion, producer of perennial Growth Brand winner BuzzBallz, “Our team is always scouring social platforms like TikTok and podcasts for organic conversations about our product that we can use to foster relationships with creators,” says Brady Bouldin, Brand Marketing Associate.

Don Julio worked with a large, diverse roster of influencers for the launch of their Rosado, through a campaign that encouraged consumers to take PTO: Party Time Off.

“We created custom content with Lukas Gage, Lisa Rinna, Remi Bader, Rickey Thompson, Kim Lee, Tefi, Corporate Natalie and Nigel Sylvester,” recounts Choi. “The entire campaign was amplified with surround-sound media tactics, including a constant stream of content on the brand’s social channels, custom e-comm activations to further drive sales, and paid amplification in OOH and high-tier media partnerships.”

And yes, alcohol is in the Metaverse.

“As a way to extend the celebration [of a distillery expansion] to our fans who couldn’t visit us in Louisville, we also created the Angel’s Envy Meta Distillery — the first distillery experience in Decentraland,” says DaDan of Angel’s Envy. “The Meta Distillery experience, which included a gamified and educational distillery tour, allowed us to reach our progressive consumers in a way that fit naturally into their increasingly digital lifestyles — and it likely helped introduce our whiskeys to new audiences as well.”

Exciting Flavors

Flavors stood out as a trend driving growth for many brands in 2022.

“Consumers are more interested than ever in trying flavored offerings, and through consumer research we satisfied their needs by unveiling Crown Royal Peach as a permanent SKU with our new platform titled ‘Peach Time’,” says Kelly of Diageo.

Many companies are looking to satiate the curious palate of the modern consumer.

“In 2023, we are launching two exciting new products. The first is Smoke Lab Saffron Flavored Vodka,” says Ginley of NV Group USA. “Saffron is uniquely Indian and is the world’s most expensive spice.”

The success of Whipshots reflects how consumers enjoy being creative with food and beverage products that they buy.

“There was no one particular flavor that drove sales more than another in the last year; our three flagship flavors — vanilla, caramel and mocha — all hit the market with extremely high demand,” says Dreyer. “It’s been incredible to see how consumers have gotten creative with the product, developing their own unique recipes, and identifying new use cases for each flavor across social media. We’ve seen equal love for each flavor throughout the line, and that love was reignited with the launch of our limited-edition Peppermint flavor.”

Regularly the recipient of multiple Growth Brands Awards, Ole Smoky Moonshine encapsulates the immense consumer demand for flavored alcohol options.

“Our Salty Caramel Whiskey is a top seller, and we’ve now become one of the fastest-growing flavored whiskey brands in the U.S.,” says Will Ensign, VP of Marketing. “The launch of our Peanut Butter Whiskey in 2020 was a remarkable success, and we made a bigger push in 2021 and 2022. We introduced a number of innovative, great-tasting new products last year, including our Moonshine Pineapples and Banana Pudding Cream Moonshine. Both products had proven success in our distilleries before being launched into broader wholesale distribution.”

Cocktails come to mind for flavored products, particularly with so many consumers improving at mixing their own drinks during the pandemic. And with on-premise thankfully recovering from the crippling lockdowns, flavored beverages have flourished at bars and restaurants as well.

Consequently, Mozart Chocolate Liqueur enjoyed “successful growth in both the on- (92%) and off-premise (109%),” says Manger. The brand found “strength in the on-premise as the chocolate liqueur of choice for milk chocolate, white chocolate and dark chocolate martinis. We are launching Mozart Coconut Chocolate Liqueur this summer, [after] big gains with Mozart Pumpkin Spice during September.”

Finally, one of the more eye-raising launches in the last year was Jameson Orange, from the Established Growth Brand.

“Jameson Orange, Jameson’s foray into the $1B-and-growing flavored whiskey subcategory, became America’s top-selling non-RTD spirit innovation in the U.S. last year, according to NielsenIQ and the National Alcohol Beverage Control Association,” says Johan Radojewski, Vice President of Marketing at Pernod Ricard USA. “Designed to appeal to both existing fans of our brand and consumers new to the whiskey category, Jameson Orange helped expand the brand to new drinking occasions and audiences, and drove overall growth for the portfolio.”

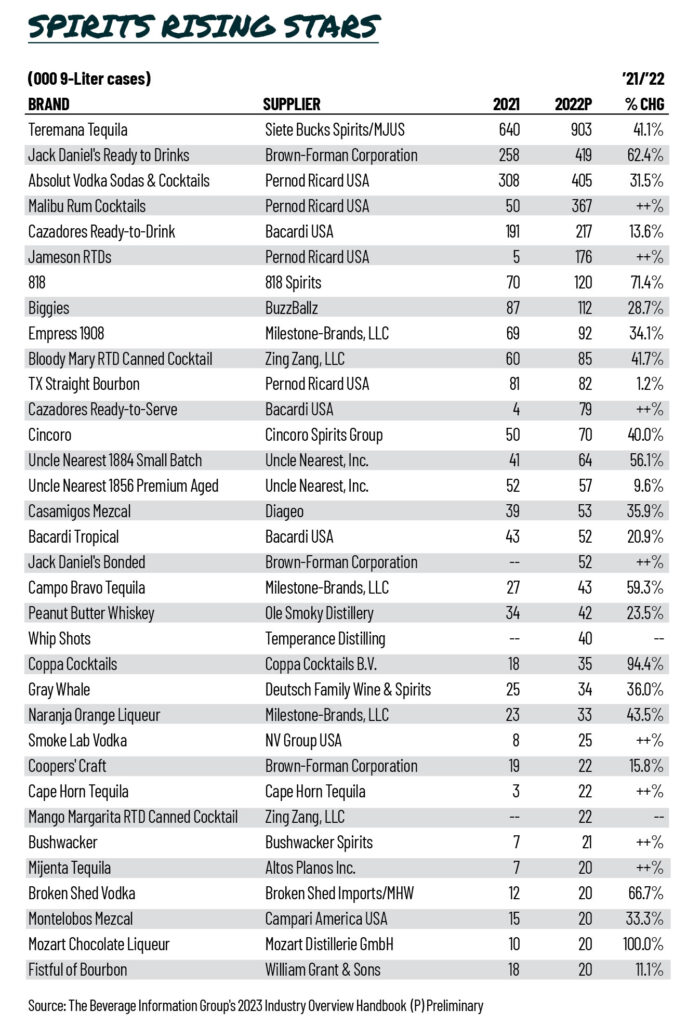

Ready to Drink

The category that grew the most during the pandemic was ready to drink beverages. Trapped at home, consumers reached for something convenient and easy, and high in quality. Moreover, canned RTDs fit naturally into social and recreational experiences that became more outdoors and on-the-go.

Even if RTD category growth curtails post-pandemic, a number of these premade beverages will have likely established sufficient consumer loyalty to remain relevant. And more keep appearing each day.

“Last year, we introduced the two ready to drink Margarita and Paloma offerings to tap into the at-home entertaining occasion, where all you have to do is add ice and enjoy,” says Needham of Tequila Cazadores. “This comes in addition to our portfolio of tequila-based ready to drink canned cocktails that launched in 2021.”

With the explosion in RTD SKUs, standing out in the category has become harder.

“We are really fortunate to have great packaging; when we hang out in stores to watch consumer behavior, we see that they are immediately drawn to the shaker-shaped bottle and its beautiful design elements,” says Chao of Coppa Cocktails. “In addition to the shaker having great eye-appeal, it clearly signals that there is a cocktail ready to go inside; then, the simplicity of the instructions on the package — ‘Just Add Ice’ — is a compelling draw to trial.”

Spiking popularity in RTDs has given rise to a wide variety of styles, including spirits-based, wine-based, and flavored malt beverages.

“In April 2023, el Jimador in partnership with Pabst Brewing Company will introduce an el Jimador FMB (flavored malt beverage) in select markets,” says Ostos of Brown-Forman. “el Jimador FMB will launch regionally in a 12-pack variety pack containing four flavors: Lime Margarita, Grapefruit Paloma, Pina Coconut Margarita, and Orange Sunrise.”

When it comes to wine RTDs, a clear leader is BuzzBallz, which attracts a lot of attention as a grab-and-go item.

“Our wine-based BuzzBallz Chillers are top-selling items for us, especially in convenience,” Bouldin says. “We have five of those flavors ranked within the top 25 wine items in the U.S., according to U.S. Convenience Nielsen data from 2022, including the number one and two spots held by our Choco Chiller and Lime ‘Rita, respectively. The Choco Chiller is the #1 top-selling RTD in convenience as well.”

All manners of brands and producers found their ways into this space in the last 12 months.

“With whiskey holding the position as the fastest-growing RTD spirit base by +347% in 2022 — including a strong demand for whiskey-forward cocktails — Jameson introduced a range of RTD Jameson cocktails, including Jameson Ginger and Lime and Jameson Lemonade and Cola,” says Radojewski. “Both simple-serve recipes were received positively by consumers, and served as an approachable way for whiskey-curious drinkers to enter the portfolio.”

On-Premise Returns

It’s no secret that many beverage alcohol retailers have seen some form of decline in their bottom lines in recent months. Why? Threefold. With on-premise shut down or hampered, the pandemic brought unsustainable growth for off-premise. Nowadays, inflation has consumers watching their wallets more closely. And the post-Covid recovery of on-premise has people flocking to bars, restaurants and outdoor venues. The brands have noticed.

Tequila Cazadores has a “prominent footprint at culinary festivals, leveraging our Mercadito experiential platform, most recently showing up at the South Beach Wine & Food Festival in Miami, where we hosted the signature Tacos & Tequila event in late February, which brings us up close with consumers,” says Needham.

Hard to believe, considering where we were just a few years ago, but concerts are back.

“In 2022, Wild Turkey continued to highlight their passion for telling bold stories through authentic music with the 101 Bold Nights program, which included a strong presence at music festivals and cultural events in Kentucky, Tennessee and Texas, as well as the 101 Bold Nights flagship benefit concert in Austin, TX,” says Watson.

“This year, we have partnered with iHeart Radio to bring 101 Bold Nights to more people through select music festivals and cultural moments, similar to how we activated in 2022, but increasing our outreach to include more cities and more bespoke concerts in locations such as New Orleans, LA, Charlotte and Wilmington, NC, Nashville, TN, Austin, TX and Los Angeles, CA,” he adds.

In Kentucky, as more people feel comfortable traveling, whiskey tourism has reached new heights.

“In June 2022, we unveiled an $8.2M-expansion to our brand home in downtown Louisville,” says DaDan of Angel’s Envy. “The expansion added five tasting rooms and a new event space, doubling our annual guest capacity, and allowing us to welcome an additional 64,000 guests each year to our home in the heart of the city.”

The backbone of on-premise will always be the backbar, a crucial place where brands jockey for the attention of cocktail-makers.

“As the on-premise business continues its strong comeback, the combination of the margarita trend and this brand’s presence in this channel have made a successful year for el Jimador,” says Ostos of Brown-Forman. “For el Jimador, the growing preference for margaritas in the on-premise occasion resulted in positive gains for el Jimador Silver.”

With people back in bars and restaurants, bartenders have once again become critical in exposing consumers to brands and trends.

“Since its launch in 2010, VIDA Clasico has been considered the bartender’s gold standard and leads portfolio sales globally. It’s the cornerstone of a Del Maguey green wall, paving the way for accounts and consumers to expand their mezcal journey into the higher expressions of the portfolio,” says Craig Johnson, Head of the American Whiskey Collective & Agave Portfolio at Pernod Ricard North America.

Del Maguey earned a Fast Track award this year.

What’s Next?

As consumers enjoy experimentation, try new flavors and seek premium products, it’s no surprise that many Growth Brands Awards winners have big plans and new launches set for the year ahead.

“We have two exciting new expressions we’ll be announcing in the coming months that we can’t wait for people to enjoy,” says Johnson of Pernod Ricard North America, speaking of Fast Track winner Jefferson’s Bourbon. “Besides the new products mentioned, Jefferson’s will soon launch an entire refresh of its packaging that honors its past while representing the brand moving forward. In addition, we are continuing to plan towards our new state-of-the-art, carbon-neutral distillery, which will be opening at the end of 2024.”

Over at Smoke Lab Vodka, “later this summer, we will launch the first gin from India on the U.S. market in the growing super-premium price segment,” says Ginley.

Vodka is not the only spirit receiving the smoked treatment. Patrón in late March announced the launch of their new Ahumado Silver and Reposado tequilas. These expressions are made with mesquite-smoked agave: harvested pi–as are roasted in small batches with mesquite charcoal for seven days in underground stone pits at Hacienda Patrón in Jalisco, Mexico.

Similar to other brands that use their tasting rooms for consumer research, Ole Smoky Moonshine “evaluates the best-sellers at our four distilleries and will be introducing a few new winning items into the national wholesale market in 2023, including Orange Shinesicle, Hot & Spicy Moonshine Pickles and Banana Whiskey,” says Ensign. “Based on the success of our whiskey products, we’re also planning to release a few of our flavors in additional 1.75-L and 375-ml. sizes this year.”

In 2023, Coppa Cocktails will launch Coppa Cocktails Espresso Martini and Passionfruit Martini in the U.S. “We are already distributed in 50 countries, and those two expressions are big winners overseas,” explains Chao.

Brown-Forman made acquisitions in 2022 geared towards growth in years ahead. “With the addition of Gin Mare and Diplomatico, we’ll have a strong presence in super-premium gin and rum, which are both experiencing significant growth,” says Petry. “Of course, as the new Jack Daniel’s & Coca-Cola RTD enters new markets, I expect we’ll see a nice bit of growth there as well.”

Which is all to say that one pandemic trend that appears to have slowed is consumers sticking with a handful of specific brands. Panicked during the pandemic, people rushed into retail stores and reached for whatever they knew best. On-premise closures also significantly crippled experimentation.

Pre-Covid, one of the biggest trends was maximum variety. Consumers wanted to explore across a wide variety of brands and categories, loyal to nobody. Will we return to such behavior, now that bars and restaurants have reopened, concerts and alcohol festivals restarted, and people feel comfortable perusing the aisles of beverage alcohol retailers? Has the age of experimentation returned?

It’s difficult to answer. Perhaps a better question is: How much stock do we put in Covid era trends? A time of unprecedented social disruption, a generational plague, unquestionably altered certain aspects of all industries. Broader ecommerce and frictionless transactions seem here to stay. But what else is permanent? Mask-wearing is down to a fraction of people. Slower to recede, remote working is nevertheless also shrinking as we progress beyond the pandemic.

Elsewhere, things feel . . . sort of normal again. The cities feel normal. Travel feels normal. Bars, restaurants, taprooms, wineries and distilleries all feel normal. But it’s certainly not 2019 anymore. The world has changed and remains ever-changing, pandemic or not. That’s why we recognize alcohol brands like those listed here that achieve growth in environments of all kinds and amidst consumer trends that can shift considerably, one way and the other, in a matter of a few short, challenging years.

Kyle Swartz is Editor of Beverage Dynamics. Reach him at kswartz@epgmediallc.com. Read his recent piece, What’s New at the Top Kentucky Bourbon Distilleries.