Tequila producers today have an enviable luxury problem: making sure there is enough of the classic Mexican spirit to go around.

Maintaining a steady supply during a time of unprecedented growth has been an important milestone, as tequila has recently outstripped overall spirits growth in the U.S. Brands and brand extensions are proliferating, while prices rise, perceptions of quality improve and consumers continue to develop a healthy interest in exploring the varieties of age statements, production methods and expressions that distillers produce.

“The tequila category is currently outpacing bourbon and North American whiskey, with trends indicating 6.5% tequila growth compared to 6% bourbon growth, according to Nielsen,” says Herradura brand manager Jennifer Simmonds. “Trends also indicate that consumers are trading up into the premium and super-premium spaces, as they become more educated on the category and 100% agave tequilas.”

“The most impactful market condition is the growth of high-end tequila offerings,” says Malini Patel, Beam Suntory’s VP of tequila and innovation. “Today’s tequila consumer is more aware of premium variants and 100% agave offerings than compared to previous years. As consumers continue to trade up, they’re finding that new innovations satisfying their need for unique offerings.”

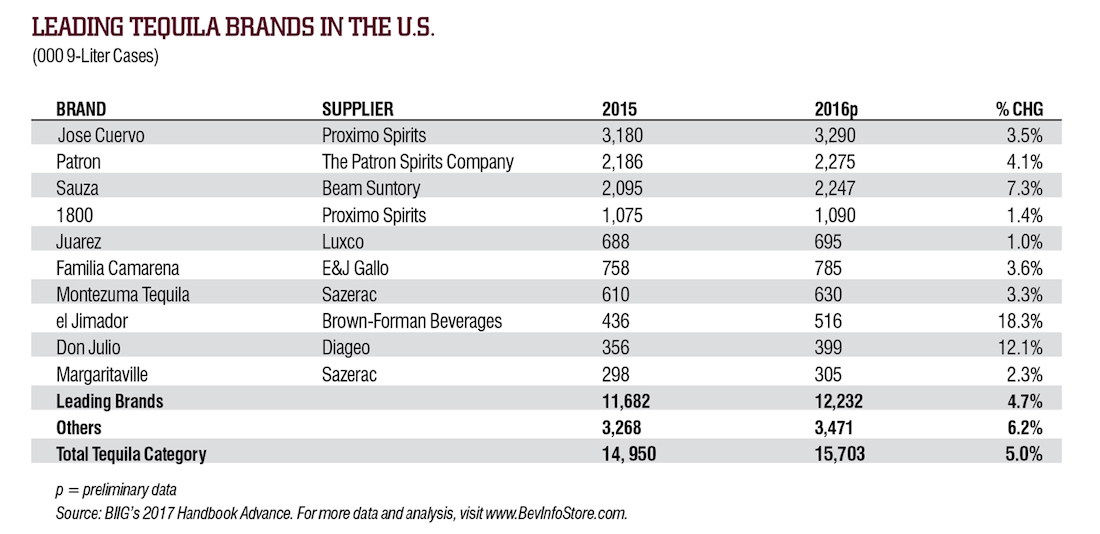

Preliminary numbers from the Beverage Information & Insights Group show tequila overall continuing to grow at a healthy 5% clip, capitalizing on the shift towards high-end spirits, and last year hitting 15.7 million nine-liter cases. Now, about half of tequila exports are 100% agave, compared to less than 15% of brands over a decade ago.

Planning for Future Sales

While this level of growth is clearly good for a spirit that counts the U.S. as the most significant export market by far, managing that growth has increasingly become an issue south of the border. Tequila may be the most agriculturally-dependant spirit sold; a steady supply of healthy 8-to-12-year-old agaves requires the sort of planning and foresight not required for other spirits. Corn grown to make bourbon, rye for the whiskey that bears its name, and even grapes for brandy and Cognac, are annual crops and producers of those spirits rarely grow their own source material. Longer growth time, regional restrictions and limited availability that agave productions entail often mean tequila producers are growers as well as distillers.

And now, with the increased interest in tequila’s aged expressions and innovations, producers each year sell more reposado, añejo and extra añejo versions, on aggregate, than ever before, making steady supply of both agaves and aged products more important as these pricier expressions gain popularity.

That makes planning integral to the future success of tequila. For smaller brands without their own distilleries, longer-term deals with distillers are essential. For most of the larger brands, a combination of piñas matured in brand-owned fields plus purchases from contracted suppliers is standard. “We own our own fields and production,’ says Pernod Ricard USA’s Altos brand director, Tina Reejsinghani. “Yes, there are always outside influences and supply issues, but as much as possible we don’t let it affect our business and that helps in keeping the price accessible.”

Like most brands, those in charge of Altos make sure aging stock is available for markets using a forecasting model, establishing some level of control based on market expectations for the next few years while keeping track of how different expressions are selling, especially now that the brand has recently introduced an añejo expression.

It’s a common response from brands at a certain level of sales, although modeling the future is risky business, especially given agave’s susceptibility to diseases and the shifting market for raw material.

Following a surge in demand in the early 2000s, agave prices skyrocketed and many producers were forced to limit 100% agave expressions and push their mixto (51% agave) brands. With consumption growing, farmers started planting more agave and by 2005, overproduction knocked the bottom out of the market. By 2008, many farmers abandoned agave for corn and piñas were left to rot.

Because of the boom and bust cycles, large tequila brands have begun to take more care in monitoring their agave nurseries. “At Casa Sauza, we own and manage our agave supply – 10,000 acres of our own agave fields and 13 acres of land used for the agave nursery,” Patel says. “This is really important, as it means we likely won’t see the challenges other manufacturers will face once Mexico’s agave oversupply levels out.”

It’s a similar case at Herradura, says brand manager Jennifer Simmonds. “We stay close to what is happening in the agave market and plan and project our longer-term agave needs multiple times per year to ensure we are meeting demand. At Casa Herradura, we take great pride in harvesting our own agave.”

Says Megan Hurtuk, tequila marketing manager at Sazerac in charge of Corazon, Siete Leguas and Pueblo Viejo, “The price of blue agave has doubled since mid-2016. However, we have seen fluctuations due to supply in years past. Our expert partners tell us to expect prices to level off over the next two years or so.”

In order to keep up, producers have boosted their agave crop accordingly, and many of the large manufacturers have turned to more efficient, if less traditional, methods of extracting sugars from agave piñas during production. But however they manage it, supply today is more important than ever.

“Volatility of the agave market is nothing new and we’ve known this since Campari decided to become a player in the tequila market,” says Christine Moll, Campari’s category director for tequila. “Our master distiller has more than 50 years in the tequila business and knows how the supplier and farmer marketplace works, and he’s been thinking short- and long-term in order to get the right amount of supply. We monitor the market very closely to ensure we can provide great quality liquid at an accessible price point.”

Highlighting Heritage

Marketers are well aware that for many spirit consumers – especially the oft-discussed Millennials – the connection made with tradition and heritage makes a difference.

“There is a rich history, culture and authenticity of spirit that comes from hundreds of years of Mexican distilling tradition,” Hurtuk says. “Today’s consumer craves a real story behind the products they embrace, and as we are exposed to more of the premium and artisanal spirits out of Mexico, consumers are finding that and demanding more.”

Story aside, though, Hurtuk says tequila brands must stand on their own quality, value or other selling points. “We strive to bring some combination of these unique attributes to our consumers in this high-energy and growing category.”

“Unique attribute” certainly describes the annual release of Corazon iterations called Expresiones del Corazón, a limited release concept that is the type of development to lend a halo effect to the base brand. The expressions – Buffalo Trace reposado, Old Rip Van Winkle Añejo, Sazerac Rye Añejo, George T. Stagg Añejo and handy Sazerac Añejo – take the tradition of aging tequila primarily in used whiskey barrels to the next step, by tying the wood used in each expression to the specific spirits and brands it previously held.

While tequila’s heritage is much discussed by brand managers, much of the category is still young. Tequila Herradura is credited with the introduction of the world’s first reposado and extra-añejo tequilas in 1974 and 1995, respectively. Other brands, especially those fairly new to the market, have similarly looked at traditional tequila production methods and sought improvements that allow their wares to break out of a crowded field.

For Blue Nectar, for example, that means the reposado “Extra Blend” mixes spirit aged in whiskey barrels for six to eight months with some three-year-old extra añejo; for the añejo “Founder’s Blend,” standard añejo is blended with five-year extra añejo; and for the reposado “Special Craft,” standard reposado is spiked “with essential oils and a hint of agave nectar.” The latter represents a practice – certain additives at certain percentages are allowed to be added to tequila by the Mexican agency that controls production – that is frequently used by numerous distillers. Few have come right out and said so the way Blue Nectar has, says co-founder and COO Nikhil Bahadur.

Building a Base

Numerous brands first enter the U.S. market with a blanco expression, either to build the brand’s reputation first through the most popular form of tequila while waiting for stock to age, or because of marketing decisions. In the case of Pernod Ricard’s Altos brand, establishing the connection with the bartender community first was paramount. Altos was developed by two English bartenders to be a high quality, well-priced brand, and the main focus was on blanco before developing and releasing an añejo expression.

And keeping brands within a portfolio distinct is also a growing concern, as suppliers add multiple tequilas. “Tequila Herradura’s marketing efforts are focused on production and superior quality, by telling its tequila-leadership stories and touting its gold medal award-winning spirit,” Simmonds says. “And el Jimador is focusing efforts on the camaraderie of enjoying tequila, and positioning itself as a lifestyle brand in the premium space.”

For newer brands, keeping up with how suddenly popular they have become is a real issue. Moll, in charge of Tequila Espolon, is happy with the success.

“Tequila overall is on fire, and in only five-and-a-half years in the marketplace, Espolon just surpassed 200,000 cases. Espolon offers a high-quality tequila at a very acceptable price point. That’s certainly been a key factor to success. Secondly, we also offer a fresh and compelling take on Mexican culture, tapping into consumers’ desire for authentic brands and stories.”

For Espolon, that’s particularly clear in its Dia de los Muertos design and iconography, which has gone a long way to help the brand stand out on the shelf. And like other brands, extending the selection has helped drive sales. Last year Campari released Espolon Añejo X, a limited edition six-year-old extra añejo that is said to be a result of a fortuitous discovery of aged stock by the brand’s distiller. And perhaps doubling down on the brand’s reputation for affordability, Espolon is releasing a 1.75-liter size for blanco and reposado expressions this spring.

Managing Growth

How retailers manage this growth is also a concern for marketers, as shelf space is in such demand from the explosion of brands in all categories. Reejsinghani says she’s been noticing how shelf sets for tequila have exploded and that retailers tell her they expanded well beyond national brands. “They tell me that many of the newer brands are selling because people coming in are looking for something new and unique,” she adds. “There’s a huge opportunity in the off-premise, even though Altos was created by two bartenders for the on-premise.”

Hurtuk says opportunities abound for tequila, and its growth prospects certainly look rosey. “The most exciting and energizing aspect of the growth in the agave spirits space, in my opinion, is that you’re seeing a lot of new and non-traditional tequila drinkers coming into the fray through cocktails, craft spirits or even whiskey,” she says. “Bartenders have certainly embraced agave spirits overall, so in markets where there is a mature or burgeoning craft cocktail scene, you’re sure to find some advocates on the other side of the bar. We are definitely seeing a younger demographic who are embracing the category, along with other premium spirits segments.”

While the looming issues between the U.S. and Mexico, regarding immigration and the potential levy of taxes on imported Mexican goods looms large, few companies would comment on hypothetical reactions. Pernod-Ricard’s Reejsinghani points out what most in the industry already know. “As a whole we are concerned about the possible border adjustment tax and know that it wouldn’t be good for consumers, and we’ve expressed our concerns through the Americans for Affordable Products [a lobbying and interest group] to ask Congress not to do it.”

While tequila prices have crept up, especially as some brands set themselves up as luxury spirits, any large price increase would present a challenge. But if nothing else, as tequila quality has improved, Americans have proven they are willing to pay more for what is rapidly becoming one of their favorite spirits. It’s a trend suppliers and retailers count on, whatever the political climate. bd

Jack Robertiello is the former editor of Cheers magazine and writes about beer, wine, spirits and all things liquid for numerous publications. More of his work can be found at www.jackrobertiello.com.