After some slight ups and downs during the first three years of the pandemic, total wine consumption took a dip in 2022. It decreased 1.1% last year to 344.1 million 9-liter cases, according to preliminary figures from the Beverage Information Group. In fact, it appears 2022 may be “giving back” all the wine volume increases over the past five years.

The headwinds facing the wine industry are very real and well documented, from the ever-increasing competition with spirits and cocktails to the barrage of ready-to-drink alcoholic beverages flooding the market.

It doesn’t help matters that many people are drinking less alcohol overall these days, not to mention the fact that wine is not connecting with younger and multicultural consumers the way that other categories have.

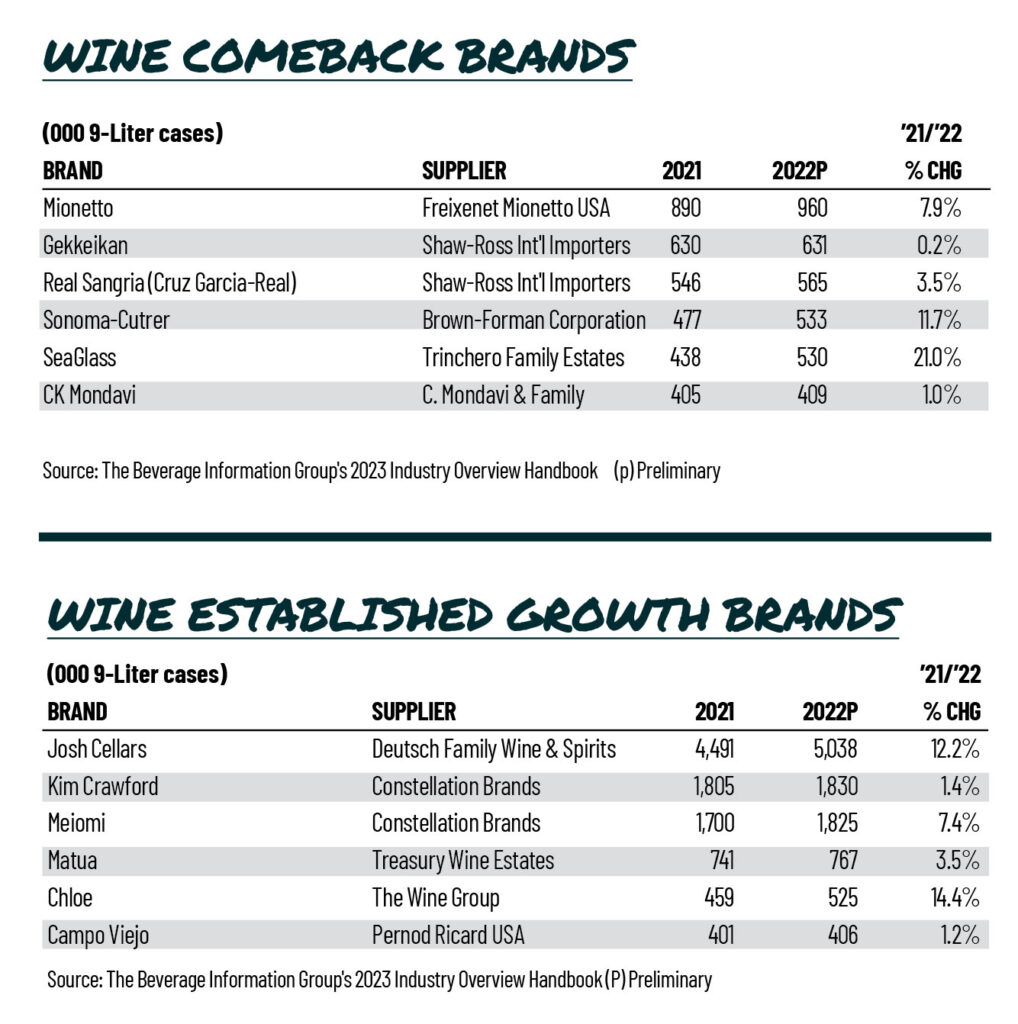

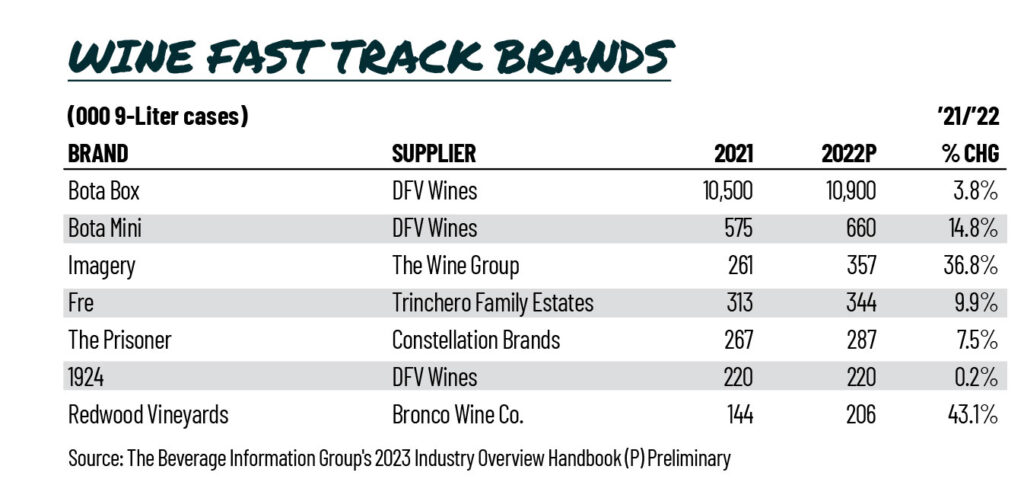

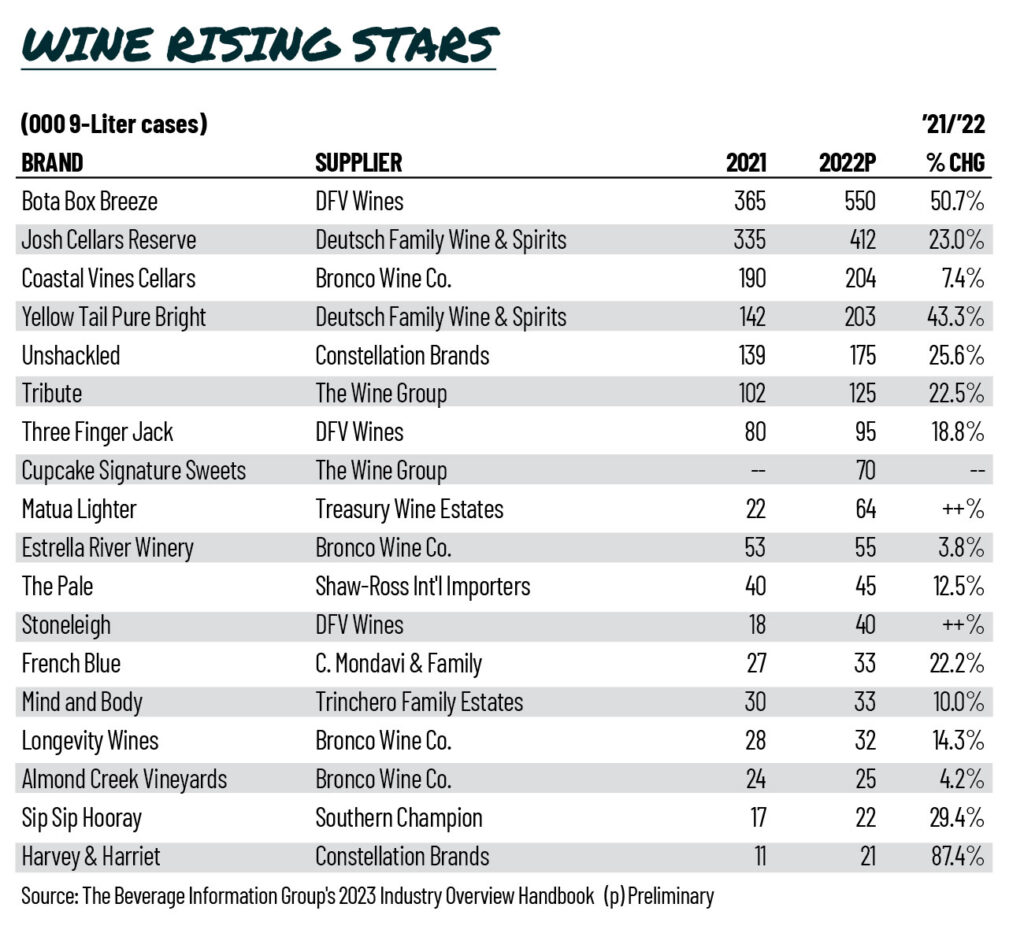

So how does a new or established wine brand manage to grow these days? Here’s a look at some of this year’s crop of Growth Brand winners and a few ways that they have expanded their business in 2022. (And don’t forget to check out our 2023 Spirits Growth Brands Awards.)

Young and Fun

One of the key issues for wine today is that many younger adults consider it to be a special-occasion drink, says Marina Velez, research director for The Beverage Information Group. The wine industry as a whole will need to expand that mindset to grow wine among younger adults of legal drinking age, she says.

Rising Star winner The Pale, a rosé brand unveiled in 2021, was built on the idea of “the new roaring 20s” and “getting back to fun” after the worst of the pandemic, says Sydney Kalvin, director of marketing for Shaw-Ross International Importers.

For the brand’s launch, Kalvin notes, “it was all about grabbing a few bottles and enjoying them with friends at home. So for 2022 we really just shifted that messaging to grabbing a few friends and head out for a fun night out with The Pale.”

Accessibility can be key to attracting a younger generation, either through approachable flavore or more budget-friendly prices. C. Mondavi & Family earned a Comeback Brand Award for the affordable CK Mondavi line.

The collection includes pinot grigio, sauvignon blanc, chardonnay, buttery chardonnay, cabernet sauvignon, dark cabernet sauvignon, merlot, red blend, white zinfandel and moscato, available nationwide for a suggested retail price of $7.99 for a 750-ml. bottle and $14.99 for a 1.5-liter magnum.

CK Mondavi, which is a majority woman-owned company, partnered with American winemaker Stephanie Rivin on French Blue wines. The brand — a Rising Star Award winner — puts an American twist on Bordeaux wines at an accessible price point of about $15 for a 750-ml. bottle. The Appellation Bordeaux Contrôlée (AOC) wines are “made with great respect for the land and vineyards, each of the wines has a modest charm that beckons to be enjoyed with friends,” the company says.

Trading Up

French Blue isn’t C. Mondavi & Family’s only initiative to step up value and price points. The company released CK Mondavi Family Select in spring 2023, a chardonnay and cabernet sauvignon created by winemaker Angelina Mondavi with a suggested retail price of $15.99 per 750 ml.

Why the shift? According to Pam Novak, vice president of marketing at C. Mondavi & Family, research indicated that CK Mondavi & Family consumers are willing to trade up to a higher price point, and are younger than its competitive set.

“Consumers are leaving lower-price segments in favor of better-quality offerings,” says Stacy Weisgerber, director of marketing for The Wine Group’s Imagery Estate Winery, a Fast Track winner, and Tribute Wines, which is a Rising Star brand this year. “Younger consumers are often drinking less, but spending more per bottle,” she says. “In a premium price segment, we’re benefiting from consumer trading up and looking for quality.”

Tribute, a brand spearheaded by Chris Benziger — the youngest of the seven Benziger siblings — is driving growth in both retail and on-premise, says Weisgerber. “Benziger’s passion for telling the brand story helped build momentum for Tribute and continues to drive its success.” The Tribute brand aims to deliver rich, bold wines rooted in multiple generations of Benziger family winemaking, crafted to celebrate relationships, bonds and milestones — big and small, she adds.

Launched in 1986 when winemaker Joe Benziger partnered with artist Bob Nugent, Imagery includes unique artwork on every label. “Imagery’s household penetration increased 33% in 2022, with growth driven by strong on premise, direct-to-consumer sales and the continued partnership with Delta Airlines,” Weisgerber says. Imagery cabernet and chardonnay are featured as the premium beverage across all Delta domestic flights.

At the same time that some brands aim to head a bit more upscale, some of the higher-end wineries are looking to make their offerings more accessible with lower-tier brands. Booker Vineyard, acquired by Constellation Brands in 2021, launched Harvey & Harriet in 2019 as a lower-price option to its core line.

Harvey & Harriet, named for winemaker Eric Jensen’s parents, retails for about $30 per 750-ml. bottle. The Rising Star winner, which the company describes as “affordable, cult-style wine,” grew a whopping 87.4% in 2022.

The Lighter Side

In addition to the struggle to attract younger consumers, another headwind for wine is that it’s less likely to be considered a “better for you” option, compared to hard seltzers and low-/no-alcohol beer, says Velez. But several wine brands have launched lower-calorie, lower-alcohol extensions. Treasury Wines, for instance, two years ago released the lower-alcohol Matua Lighter, which won a Rising Star award this year.

Trinchero Family Estates has FRE Alcohol-Removed Wines, a Fast Track Award winner, and Mind & Body, a premium, low-calorie, low-alcohol brand that launched two years ago and won another Rising Star Award.

The Australian wine brand Yellow Tail, imported by Deutsch Family Wine & Spirits, in May 2021 introduced Yellow Tail Pure Bright, a lower-calorie and lower-alcohol wine. The line, which includes chardonnay, pinot grigio and sauvignon blanc, grew 43% in 2022 and won a Rising Star Award this year.

Bota Box Breeze, a three-year-old line of 3-liter boxed wines that’s lower in calories, carbohydrates and alcohol, won another Rising Star Award in 2023. Bota Box, from Delicato Family Wines, also won Fast Track Award for its core boxed wine product and its Bota Mini extension.

How Sweet It Is

Another way to bring in younger LDA drinkers is with sweeter and fruity flavors. The Wine Group’s Cupcake Vineyards in March 2022 unveiled its Signature Sweets collection. The line of sweeter, lightly sparkling wines, which are 5.5% ABV and come in four naturally flavored varietals: Sweet Red, Peach, Watermelon and Berry, won a Rising Star Award this year.

What’s more, Cupcake in April 2023 released Citruskissed Pinot Grigio: a vibrant, crisp and fruity wine with prominent notes of lime and lemon zest. The new wine has a suggested retail price of $12.99.

The focus on low-ABV and sweet wines has helped Real Sangria win a Comeback Brand Award, says Ricky Febres, national brand manager at Shaw-Ross International Importers. “We have found that the growth in the ‘sweet wine’ category is an opportunity for us to introduce Real Sangria to a new consumer group because sangria, which is wine blended with fruit juices, is the original sweet wine.”

Catering to Cocktail Lovers

Febres says that the current program focuses on Real Sangria cocktails, which is “an easy, low-ABV alternative that we know brings in a lot of buying power.”

Another Shaw-Ross brand, Gekkeikan sake, which earned a Comeback Brand, has been focusing on a range of cocktails made with sake and attempt to wide distribution across the on-premise spectrum.

“The new generation of drinkers has been fascinated with craft cocktails for a few years now, and this is something we really want to embrace” with The Pale in particular, says Kalvin of Shaw-Ross. “When Sacha Lichine created The Pale rosé in 2021, he wanted to make a more playful rosé and even designed the bottle to be akin to a spirit bottle, so why not take that inspiration and move it forward?”

The Pale launched as an off-premise brand, Kalvin says, “but in 2022 we really wanted to shift the focus and build our on-premise footprint as well. Our strategy was to show the diversity of the brand: Not only is it a great value Provence rosé for by the glass, but it can also be used to make delicious cocktails.”

Campo Viejo, a Pernod Ricard brand from Spain’s Rioja region, has been promoting several cocktail recipes made with its wines. For instance, the Established Growth Brand Award winner reently created a tequila-based Rosérita drink that uses its rosé and a Sparkling Margarita that incorporates its cava.

Sip Sip Hooray, a single-serve, ready-to-drink wine cocktail from Southern Champion, won a Rising Star Award. Made with agave wine, the 13% ABV RTDs come in Lime Margarita, Mango Margarita and Strawberry Margarita flavors.

Bubbles Still Pop

The continued consumer interest in rosé wine and the demand for alternatives to Champagnes helped deliver a Comeback Brand Award for prosecco brand Mionetto, says Enore Ceola, CEO of Freixenet Mionetto USA. “Prosecco remains a key driver within the sparkling wine category, but domestic and cava options are on the consumer’s radar,” he notes.

It also helps that more consumers are celebrating everyday occasions and milestones with bubbly wines, Ceola says. “You no longer need to have an occasion or celebratory moment such as a birthday or anniversary — you can have a glass of sparkling just because it is Monday.”

Mionetto, which in 2023 celebrates 25 years in the U.S market (for more see sidebar on page 34), introduced a 375-ml.-bottle format this past year. The half-bottle size provides more options and makes it easier for people to choose sparkling.

The company also leveraged an integrated strategy with a focus on point-of-sales materials and displays, and introduced new content on its social media platforms, says Ceola.

Overall in 2022, “Retail trends were mixed due to strong trends in 2020 and 2021, but higher than in 2019,” he notes. “On-premise had strong performance in select markets and overall across the U.S.”

New Zealand sauvignon blanc also remains a popular category, as evidenced by Growth Brand Awards for wines such as Kim Crawford and Matua. Delicato Family Wines launched the Stoneleigh brand in the U.S. in 2021. Stoneleigh, New Zealand’s number-one wine brand, won a Rising Star Award this year.

Gunning For More Growth

This year’s winners have plenty of strategies in place to keep growing. Febres, for one, says that Shaw-Ross will be building on Real Sangria’s strong foundation. “This year we are introducing our first line extension with Real Sangria Peach, a Spanish rosé wine blended with fresh, juicy peaches for a perfectly balanced sweet beverage with a pretty pink hue.”

Josh Cellars, which won Rising Star Awards for its core brand and its Josh Cellars Reserve, expanded its portfolio in early 2023 with the launch of Josh Cellars Hearth cabernet sauvignon. The new red wine selection from the Deutsch Family Wine and Spirits brand was inspired by the hearth, the center of the home where people can come together to enjoy comfort and warmth, the company says.

Tribute will continue to honor the Benziger Family legacy and “Pay Tribute” by donating a portion of the proceeds to Pets for Patriots in recognition of Chris Benziger’s father, Bruno Benziger, who served as a Marine, says Weisgerber. “Pets for Patriots is a national nonprofit serving veterans and saving shelter animals through companion pet adoption.”

The Imagery Wine Collection will emphasize its packaging that was inspired by a legacy of artistry at its Sonoma Estate, Weisgerber says. “In 2023, we will continue the rollout of our new “Drop of Inspiration” campaign that harnesses the stopping power of the iconic drop on our package.”

Mionetto also has packaging initiatives in store for 2023. “Our signature orange Pantone 27-degree angle label, synonymous with the iconic Mionetto Prestige Prosecco DOC Treviso Brut, is set to expand across the portfolio to the Organic Prosecco DOC, Prosecco Rosé DOC and Valdobbiadene Prosecco Superiore DOCG,” Ceola says.

Kalvin predicts that 2023 will be a good year for The Pale, in part thanks to in-person programs. “One of our big initiatives is going to be events, which have been so important for The Pale thus far,” she notes. “We really want to get the Pale in front of as many people, in as many markets as possible.”

Feature photo by Elisha Terada on Unsplash.

Melissa Dowling is editor of Cheers magazine, our on-premise sister publication. Contact her at mdowling@epgmediallc.com, and read her recent piece, Sherry Pairing Suggestions.