Consumer trends in the alcohol industry have shifted significantly in recent years and the rum category has evolved accordingly. The Covid-19 crisis has even more people focused on health and wellness, while the influence of the Millennial and Gen-Z generations has only grown.

Meanwhile, several trends that had flourished pre-pandemic have picked up steam. Namely: Premiumization, barrel finishes and canned cocktails.

Which is all to say that many factors are in play as rum companies position their products for 2023 and beyond.

Rum Premiumization Remains Key

Before Covid ever reached our shores, and consumers began splurging on their home bars, peopsle had already begun eyeing retailers’ top shelves. Nothing here has changed.

“We first launched our premium rum portfolio in 2018, and each year, the consumer appetite for more premium, aged spirits has grown,” says Lisa Pfenning, VP Americas, Bacardi Rum Portfolio. “In fact, as a result of the growing consumer interest, we launched our limited-edition Cask Series in 2021. We first started with Bacardi Reserva Ocho Sherry Cask, then Bacardi Reserva Ocho Rye Cask, and have a new iteration coming later this summer.”

“We’re seeing the trend of premiumization take off in bars and restaurants as well,” she adds, “with 72% of bartenders reporting the most premiumization within tequila, followed by single malts, mezcal and aged rum, mostly driven by the surging popularity of rum-based cocktails.”

As with other spirits categories, premiumization in rum means more creative barrel finishes, giving consumers a wider range of innovative flavors to explore through.

“Within sipping rums, we’re seeing a big lean towards innovative cask finishes,” says Antoine Couvreur, Managing Director, Mount Gay. “At Mount Gay, we’ve been exploring this with our Master Blender Collection, where Master Blender Trudiann Branker has the opportunity to discover and push the boundaries of rum innovation. Most recently she used Madeira wine casks, and this year, she’ll release a well-aged rum in a different cask. Here, we’re seeing interest in exploring taste profiles and nuances, much like we’re familiar with in the single-malt world.”

Agreeing with him is John Meisler, Vice President Sales, Serralles USA, producer of Don Q rum.

“Industry analysts expect as much as 15% compound annual growth rates in the super and ultra-premium rum categories ($30-$100),” Meisler says. “More growth is expected as well in the $250 rum category, while the overall rum category declines are driven by the value and standard segments.”

“Scotch and Bourbon producers . . . have created an audience for unique barrel finishes,” he adds. “These tend to bring new, curious consumers to the brands/

categories, and allow rum makers to showcase their rums. For us, they are created in small batches — like the Cognac, Port and Zinfandel finishes released over the last six months.”

Millennials and Gen Z Drinkers

As younger LDA generations increasingly influence the marketplace, savvy brands have picked up on emerging Millennials and Gen Z trends.

“Both generations consume less than the previous Gen X or Boomers. In fact, Gen Z has a reported 15-18% abstention rate among its cohort,” says Brian Baker, CMO, Copalli Spirits, which makes Copalli Rum. “The primary reason for not imbibing? They dislike the taste and smell of alcohol.”

“Additionally, unlike previous generations, both Millennial and Gen Z have created a series of hurdles that brands must navigate before they will engage and/or buy,” he adds. “These generations want to know what a company is doing to give back to the world, and how they treat their employees. How does my engagement with your brand help the world be a better place? What does your brand do that helps the planet? How truly sustainable and or net zero is your product — and that doesn’t mean purchasing offsets. For a brand to succeed with these generations, it will need to have built into their DNA the very answers to these questions. And of course, make a delicious product.”

This can be to rum’s advantage, and also detriment.

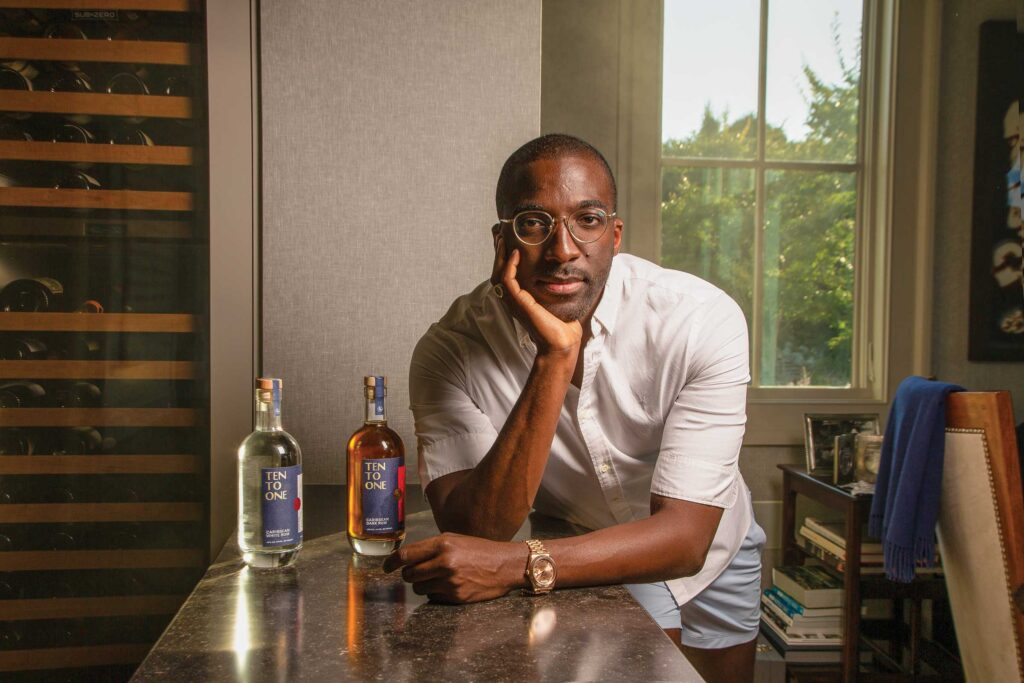

“Millennial and Gen Z consumers seem to be big proponents of authenticity — both in provenance and in craft — and also seem to embrace brand narratives that are more thoughtful in their articulation than similarly positioned brands might’ve been in the past,” says Marc Farrell, Founder of Ten To One Rum. “In many ways, one might argue that much of this is antithetical to the way that rum as a category has been historically represented in the U.S., and so I think it requires a continued shift in mindset — and a wave of new creators and thinkers in the category — to help move rum further into the hearts and minds of these emerging consumers.”

Critical in these efforts with younger consumers is when brands effectively communicate what makes their products authentic.

“The marketing that has always worked best for us revolves around sharing our passion for Ten To One in as inspired and authentic of a fashion as we possibly can,” Farrell says. “We’re always trying to raise the bar as creative storytellers and champions, not just of rum, but of Caribbean culture as a whole, and I think we’ve always been most successful when we’ve stayed true to those ideals.”

Millennial and Gen Z drinkers also gravitate towards brands with an authentic eco-conscious goal.

“We have focused on sustainability, transparency and quality in how we make rum,” says Baker, of Copalli Spirits. “Those are core themes that drive that our public relations, social media and digital outreach — and those pillars are connecting with consumers.”

“Unfortunately, there are a number of brands who’s sustainable claims are more greenwashing than authentic,” he adds. “For that reason, we are finding that transparency when it comes to our carbon footprint is gaining traction, and we are educating consumers about what sustainability really means.”

There are plenty of positive green aspects that the category can communicate with consumers.

“Rum is the only spirit that can be made from what’s left over from an industrial process,” says Ed Tiedge, Distiller, Copal Tree Distillery, producer of Copalli Rum. “When you make table sugar, you’re left with molasses. Sugar manufacturing is very efficient and quality molasses is getting harder to source. The result is that we’re starting to see those distilleries that can source fresh cane juice are using that to make rum. This is moving rum away from an industrial activity and back into an agricultural activity. At the same time, we’re also seeing more emphasis on well-made premium rums. Rums with more care in the process and source of sugar cane and less additives. This can only be a good thing for consumers and the category.”

Which also speaks to likely the largest problem facing rum: How many consumers actually know any of these things? A lack of knowledge has held back the category from further growth. Some people still think of rum as cheap and sugary, or the comically boozy stuff of pirate adventures.

How can the category combat these hurtful misconceptions? Expect more rum brands to tap into the recent explosion in popularity in whiskey and tequila, highlighting how these premium, craft spirits are all made similarly.

“I think continuing to place an emphasis on many of the elements that whiskey consumers are already familiar with will provide a boon for the category,” says Farrell. “Whether it be barrel-aging or unique cask finishes, exposing consumers to the importance of terroir from around the region, or the contrasting styles (and tasting notes) yielded by different distillation methods, there’s so much richness to the rum category that should appeal naturally to that same whiskey consumer. We just have to continue to invest in ensuring that those stories are told.”

Classic Rum Cocktails

Another area that has helped fuel rum sales recently is the latest consumer turn towards classic cocktails.

“We are seeing significant growth with classic cocktails such as Rum Punch, Expresso Martinis and Daiquiris,” says Bob Gunter, President and CEO of Koloa Rum Company. “Tiki cocktails are also showing a resurgence in popularity.”

Others have noticed this trend.

“Nostalgia — or rather, classic references — are an ongoing trend that have been threaded throughout a variety of industries, and especially within the spirits space,” says Couvreur, of Mount Gay. “When it comes to what our consumers are drinking, we anticipate the continued love for classic cocktails to drive growth in 2023. From reinventing tried-and-true drinks, like the Old Fashioned, with unique flavors, or changing one’s perspective on a historic recipe, like the Daiquiri, consumers will be looking for new ways to break outside of the norm, yet still believe in what has passed the test of time.”

A rising interest in classic cocktails is surely helped along by these drinks appearing more frequently in cans.

“Today’s consumer doesn’t want to sacrifice taste or quality, and they are seeking ‘better for you’ products. Our canned cocktails fit perfectly with this demographic shift, as they are all-natural, lower in alcohol and calories and they taste delicious,” says Gunter, of Koloa Rum Company.

Agreeing with him is Pfenning.

“According to the International Wines and Spirits Record (IWSR), the spirit-based ready-to-drink category is projected to increase $11.6 billion over the next five years, and more than 24% volume-wise within that timeframe as well,” she says. “The convenience and robust flavor profiles are the true drivers of the success of Bacardi Ready-to-Drink Cocktails.”

Whatever form rum takes nowadays — limited release, RTD, barrel finished, authentic and craft, eco-conscious, or all of the above — the category has plenty of opportunity to lean into current consumer preferences and capitalize. Whether people respond, and the category grows, will depend on how well rum brands can communicate their advantages, their similarities and difference with other spirits, while carving out additional space in a broader alcohol market that’s shifting quickly with modern trends.

Feature photo by Ash Edmonds on Unsplash.

Kyle Swartz is Editor of StateWays. Reach him at kswartz@epgmediallc.com.